Apache is functioning normally

Though FICO® and VantageScore® ranges start at 300, most new credit users don’t start this low. In fact, if you’ve never taken out credit or applied for a loan, you might not have a credit score at all.

When applying for credit cards and loans, you begin to build credit, but you may be wondering—what does your credit score start at? Most people’s initial credit scores are between 500 and 700 points, depending on the steps taken when establishing credit. However, you won’t have a credit score to report if you’ve never opened a credit account.

Read on to learn more about your starting credit score and how to build your credit over time.

What Credit Score Does an 18-year-old Start with?

Contrary to popular belief, you don’t automatically receive a credit score the day you turn 18 years old. However, you need to be at least 18 years of age to apply for credit and start building your score. Remember that if you haven’t used credit yet, you likely won’t have a score at all.

Once you start using credit, you will get a score roughly three to six months after opening your first credit account. Your credit score will be calculated based on a variety of factors outlined in the next section.

How Are Credit Scores Calculated?

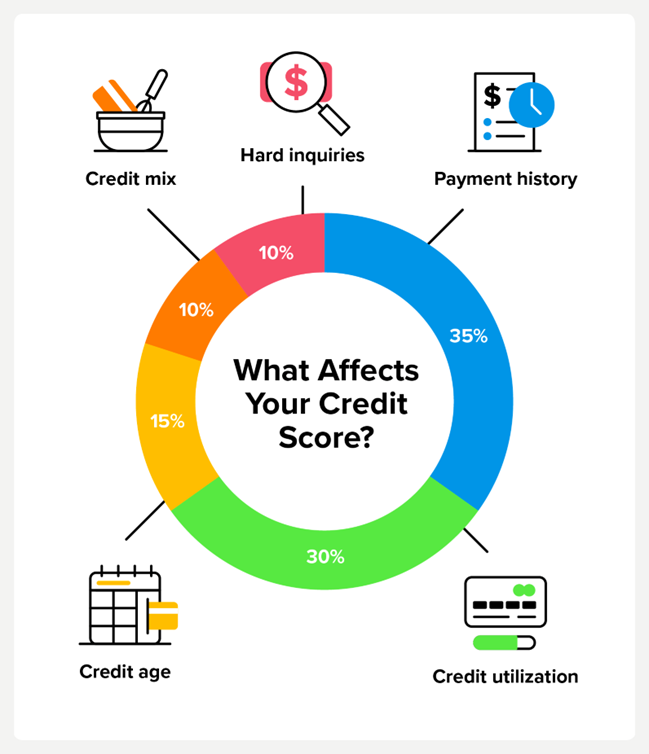

So, how are credit scores determined if everyone doesn’t receive the same default credit score? According to FICO, they use the following five factors to calculate your credit score:

- Payment history: The most important factor to determine your credit score is your history of paying credit accounts on time.

- Accounts owed: While owing money on credit accounts isn’t necessarily bad, using a majority of your available credit can lead to lenders viewing you as higher-risk.

- Length of credit history: Generally, the longer your credit history, the better it is for your score since lenders have a more accurate assessment of your risk.

- Credit mix: The different types of credit you have, such as credit cards, installment loans, and finance company accounts, are your credit mix.

- New credit: Opening too many credit cards in a short period of time can hurt your score since doing so signals to lenders that you’re a greater risk.

How to build credit

If you’re new to credit, you may be wondering how to start building your credit in the first place. Receiving a loan without a credit score might be difficult, so FICO suggests the following ways to start building credit:

- Become an authorized user on a family member’s credit card. You can be added to a card owner’s account, which allows you to make purchases with their credit card. Keep in mind that this method doesn’t have a large effect on your score but can be a good stepping stone to building credit.

- Apply for a secured credit card. As a person with no credit, your risk to lenders is considered very high. A secured credit card requires you to pay a refundable security deposit to mitigate risk.

- Report rent and other service providers. Credit and loans aren’t the only factors that affect credit. While landlords and utility companies typically don’t report to the credit bureaus, you can request that they do so to start building your credit.

How long does it take to build a 700 credit score?

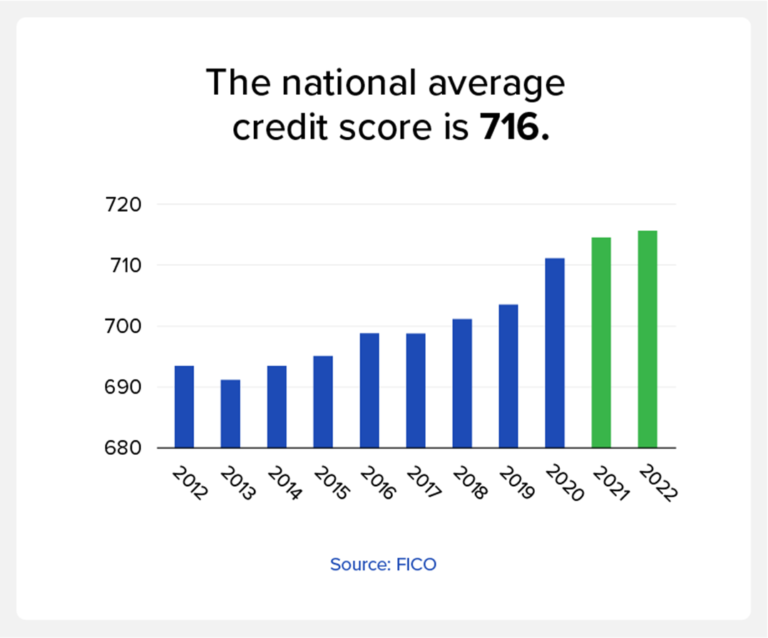

According to FICO, a credit score of 700 or above is considered good. And since the national average credit score is 716 as of April 2022, it certainly is achievable, although it will take time. If you’re starting with no credit, you can expect building a 700 credit score to take at least six months of practicing positive credit habits.

Keep in mind that there are steps you can take to increase your initial credit score and reach your credit score goal of 700 or higher credit.

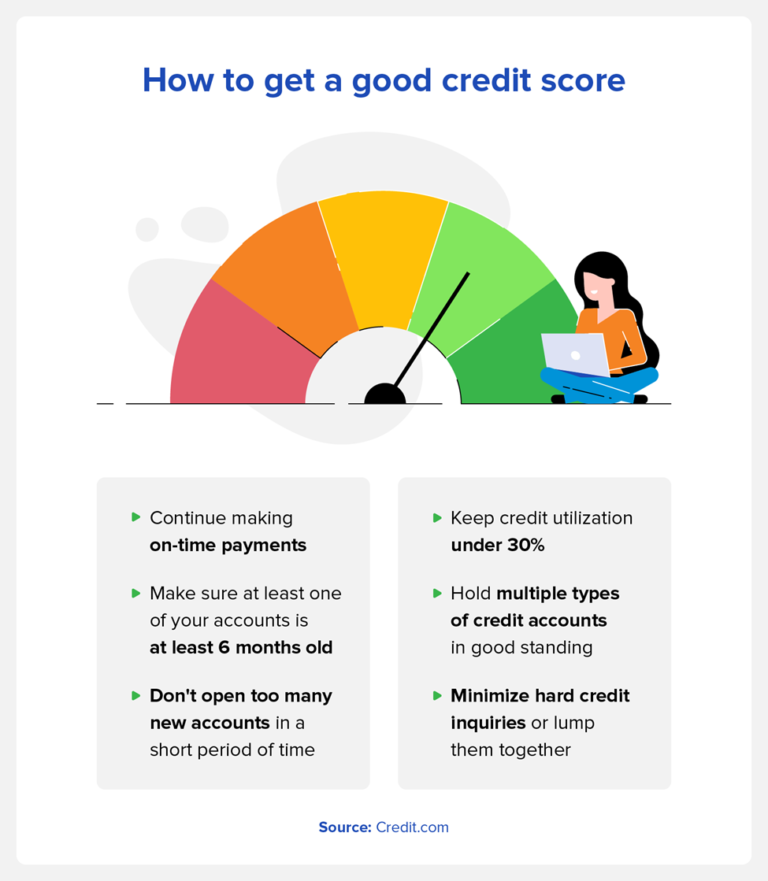

How to improve your initial credit score

So, how can you help make sure that you start out with a good credit score? Follow the tips below to improve your credit score.

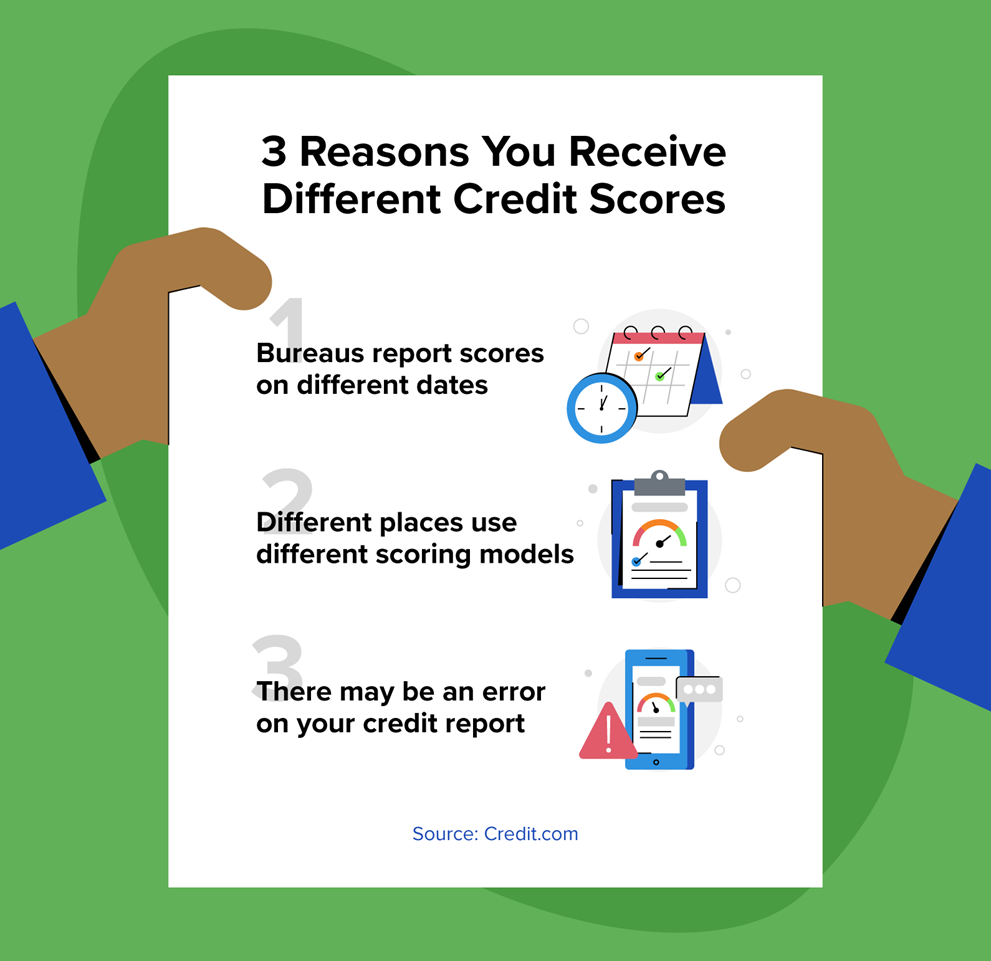

- Review your credit report. Once you open a credit account, be sure to view your credit report and look for any inaccuracies.

- Be on time with your payments. Since payment history is the most important factor that influences your credit score, be sure to pay your bill on time and avoid missing payments.

- Limit applying for multiple lines of credit in a short period of time. Applying for credit results in a hard inquiry, which may slightly lower your credit score. Too many of these hard inquiries in a short period of time can cause your credit score to drop.

- Keep your credit utilization ratio under 30 percent. Credit utilization refers to the amount of credit you’re using divided by the amount that is available to you. For example, if your monthly credit limit is $1,500, aim to use under $450 each month.

- Be patient. Again, the length of credit history is an important factor that contributes to your credit score. The more time that passes since you opened your account, the better for your score.

FAQs

Below, we’ve answered some common questions regarding your first-time credit score.

Does your credit score start at 0?

Your credit score doesn’t start at zero. In fact, the lowest credit score possible is 300. However, you likely won’t start at this score unless you’ve made actions that have damaged your credit score.

Does everyone start with the same credit score?

Everybody doesn’t start with the same credit score. As mentioned above, your individual credit score is based on a number of factors.

Is no credit worse than bad credit?

No credit means you lack a credit history, whereas bad credit means you’ve made credit-damaging mistakes, such as multiple late payments. While both scenarios can cause limitations, building credit from scratch is generally easier than rebuilding a bad credit score. As a result, it’s worse to have bad credit than no credit.

What’s a good credit score for young adults?

A good credit score is 670 and up. According to Experian®, the average credit score for young adults ages 18-25 is 679, so any score above that is considered above average for the age group.

How to check your credit score for free

Once you begin building credit, it’s crucial to follow responsible financial practices that will help you raise your credit score over time. And don’t forget to regularly monitor your credit to make sure you’re on the right track.

ExtraCredit by Credit.com gives you tools to manage your credit at an affordable monthly price so you have information you need to help you achieve your financial goals. Get started today.

Source: credit.com