How will you always know that this Commentary is not produced by some AI thingy? Because of mistakes like yesterday, leaving Illinois off the list of top pumpkin growing states as several folks pointed out (thank you). Here are pumpkin stats out the proverbial wazoo. What autumn would be complete without this map of when fall foliage is peaking across the nation? While we’re on maps, the U.S. Census Bureau released an interactive map illustrating 2020 Census data about homeownership by the age, race, and ethnicity of the householder. The map provides data at the national, state and county levels and data from the 2010 Census for comparison. The Census Bureau also released the brief Housing Characteristics: 2020, which provides an overview of homeownership, renters, vacant housing and other 2020 Census housing statistics previously released through the 2020 Census Demographic and Housing Characteristics File (DHC). (Today’s podcast can be found here and this week’s is sponsored by TRUE. TRUE creates accurate data that powers automation and optimizes every step of the lending lifecycle, helping lending organizations rapidly process loans, dramatically cut costs and risk, and radically improve the customer experience. Interview between Robbie and Rob Chrisman on chatter from the capital markets and why people should tune in to their weekly Mortgage Matters video show each Wednesday.)

Lender and Broker Software, Programs, and Services

Not many lenders know this, but you can buy down points with down payment assistance (DPA). DPA has evolved over the years, and there are 2,373 to choose from today according to Down Payment Resource’s Q2 HPI report. What’s more, consumer interest in DPA is savage, and lenders who offer it have a competitive edge. Just ask anyone who originated one of the 2,300 CalHFA programs that disappeared in just 11 days. DPA is one of the best tools lenders have in today’s market and for the foreseeable future. Want to know how many homebuyer assistance programs are offered in your markets or to learn more about how Down Payment Resource makes it easy to support DPA? Schedule a demo with the Down Payment Resource team today.

The MBA Annual Conference & Expo is just around the corner. Be sure to book time with the key players at Flagstar Bank if you’re headed to Philly for the big event. Right now, you can secure private meetings with their top execs in Corporate Mortgage Finance, Secondary Marketing, Specialized Mortgage Banking Solutions, Treasury Management, TPO Sales, and more. Don’t miss your chance to get a scoop on what’s ahead for this $119 billion asset bank, from product enhancements to tech rollouts and warehouse lending opportunities. Connect with your RM or AE to reserve a time today. If you’re not a partner yet, sign up here.

“Why should you integrate your mortgage and consumer loan origination systems? We’re sharing five key ways MeridianLink’s end-to-end digital LOS can help you break down silos, facilitate seamless communication, boost cross-sell potential, and enhance the overall borrower journey. Learn more now.”

Making meaningful, in-person connections is critical for success and at the heart of ICE Experience. Registration opened this week for ICE Experience 2024, taking place on March 18-20 at the Wynn Las Vegas, and the agenda is packed full of even more ways for mortgage professionals to grow their skillset and professional network. Plus, registration fees for this year’s conference are at a new low price of $995 when you register by January 31, 2024. If you are an ICE customer, now is the time to secure your seat to soak up the latest information, address your most pressing challenges, see new innovative solutions up-close and strengthen the relationships that are the foundation of your business. Click here to learn more.

OptiFunder announces the release of Greyhound, a highly configurable and automated system for Warehouse Lenders. OptiFunder has changed the game for IMBs by optimizing and automating the historically manual funding process. As we continue our mission to connect the primary and capital markets, we’re expanding our software offering to include a highly configurable, automated Warehouse Lending System, called Greyhound. Greyhound connects warehouse lenders with all major LOS systems, giving lenders the ability to easily onboard new clients, receive loans, and manage their entire portfolio. Leveraging OptiFunder’s LOS integrations means warehouse lenders are directly connected to over 70 percent of total industry loan volume. Greyhound offers real-time insights into pipeline management, loan/collateral tracking, operational reporting, automated LOS data import, investor shipping requests, purchase advise matching, document imaging, and more. IMBs and Warehouse Lenders should meet with OptiFunder at MBA Annual to discuss automating funding through loan sale to the capital market.

Are you well prepared to manage your servicing portfolio heading into 2024? As inflation continues to cool and the labor market starts to weaken, economists at Fannie Mae recently stated they expect a mild recession in the first part of 2024. Your servicing portfolio is a sound investment and can generate positive returns, but what happens when your portfolio starts to show signs of trouble, such as an increase in delinquencies? How will you ensure your distressed loans are making it through the proper pipeline and loss mitigation steps? It is more important than ever to ensure your servicing portfolio is ready to handle the uncertain economic future, and the team at Velocity Servicing, a LoanCare division, is ready to help! Backed by LoanCare Analytics, a proprietary data analytics platform with real-time access to portfolio data, Velocity Servicing helps lenders manage troubled loans with speed and accuracy. If you want to learn more about how Velocity Servicing can change your servicing game, email Matt Stadler or click here to schedule a time to meet with them at the MBA Annual in Philadelphia!

There is a celebration going on in Denver. It’s the 15th anniversary of a company that has been providing great software for 28 years. How is this possible? Usherpa was founded in 1995 at the second largest retail mortgage company in the country and rebranded in 2008 and is truly a firm that was “Born in a Branch; Forged in a Meltdown.” It has since grown into the largest privately held CRM company in the real estate and mortgage industries. Usherpa’s Smart CRM is the industry’s most sophisticated, cloud-based Customer Engagement Platform with the most powerful CRM and Marketing Automation systems in existence. It’s helped thousands of Loan Officers stay connected with partners and clients, helping hundreds of thousands of borrowers fulfill their dreams of homeownership. Usherpa users convert 46 percent more prospects, close 2X more deals and increase repeat business by 57 percent. They show you the studies! Win more business even in this market. Find out how here.

Autumn is not just about the vibrant leaves and cooling weather; it’s also the crucial period for renewing your NMLS license! As the seasons transition, ensure your professional credentials don’t fall behind. Diehl offers the top-tier Continuing Education (CE) you need! Our live, interactive webinars aren’t just about compliance; they’re engaging, insightful, and designed to meet NMLS requirements for the 2023 renewal season. We make mandatory learning enjoyable! With multiple dates to choose from, we have a class that works for you. Don’t wait until it’s too late! Sign up today before spaces run out!

“With over 35 years of experience in mortgage banking, Richey May knows the industry from every angle. Many of our team members are credentialed industry experts who dedicate much time to building up other industry experts. From this expertise, Richey May has created a wealth of services and products to help lenders stay ahead: audit and tax services, cybersecurity solutions designed to protect company assets and sensitive borrower information, intelligent automation tools for streamlined operations…you name it! Whether you’re leveraging our innovative platforms or having us work as your extended team for outsourced internal audit or accounting services, get ready to tackle challenges faster with some serious firepower on your side. Everything you need: contact our experts today!”

Disasters and Insurance

Many will say that it doesn’t matter whether or not you believe in climate change, manmade or natural. What matters is that investors in mortgages, servicers, and insurance companies do, as that pricing impacts people in those areas, and therefore clients and borrowers.

Progressive insurance is rebalancing its exposure in the state of Florida, and will not renew 47,000 DP-3 policies and 53,000 high-risk homeowner’s policies in the state. DP-3 policies tend to cover vacation homes and properties that are not a primary residence. That said, Progressive plans to transfer the policies to Loggerhead Insurance in a deal that will affect 100,000 policyholders. Multiple insurers are winding down parts of their business in Florida as an insurance crisis hits the state, which has high exposure to natural disasters and a ruthless roofing scam industry that has made it difficult for insurers to operate there. This has driven many homeowners to the state-backed insurer of last resort, Citizens Property Insurance Corp, which now has 1.3 million policies, up from 500,000 as of July 2020.

Florida isn’t alone. Several top insurance companies (like Farmers, State Farm and Allstate) have reduced their footprint in California over the last several months. State Farm and Allstate say they’re not writing any new homeowner insurance policies in California moving forward due to it being too expense. And just ask a homeowner in a low-lying area of Florida, Louisiana, or the Carolinas how it’s going.

Recall that in August the Biden administration urged a federal judge to reject a challenge by Florida and other states to an overhaul of the National Flood Insurance Program that has led to higher premiums for many property owners.

Nearly every part of the United States faces natural disasters, whether they be earthquakes, hurricanes, tornadoes, forest fires, drought, or volcanoes. A declaration by FEMA triggers lender and servicer policies and procedures.

On 9/19/2023, with Amendment No. 9 to DR-4720, FEMA updated the Incident Period End Date to 7/21/2023, for Vermont counties affected by severe storms, flooding, landslides, & mudslides from 7/7/2023 to 7/21/2023. See AmeriHome Mortgage Announcement 20230909-CL for inspection requirements.

PHH Correspondent posted information regarding Illinois DR-4728: New Disaster Declared, Mississippi DR-4727, and Vermont DR-4720. Go to the PHH company library to view the announcements and for all disaster declared counties, requirements, procedure.

In addition to the previously declared counties, a disaster declaration is being issued or modified pertaining to Hurricane Idalia landing causing wide-spread damage around Florida. Until FEMA has officially announced all Declared counties, PHH needs to cover this gap for areas determined to be of considerable concern to be declared a disaster by FEMA. Areas in Florida of concern not yet declared: Flood Zones only in both Hillsborough and Wakulla Counties. Go to the PHH company library to view the announcements and for all disaster declared counties, requirements, procedure.

Capital Markets

As foreign and bank buying of fixed-income securities has declined, you’ll notice all talk of an inverted yield curve leading to a recession has vanished. (The 2-year is yielding 5.12, the 10-year is at 4.73 percent.) Remember when that was trendy? A recession will happen at some point, but probably not in the near future. As markets adjust to continuously high interest rates, it is creating a new reality for bond yields, with investors now wondering how high they can go. Over the last few months, the markets were wrong because they thought inflation would come down quickly and central banks would be very dovish. Everything will depend on how inflation lands over the medium to long run, but it’s fair to say that we have changed from the ultra-low-yield regime.

Rates continued their rise to open the quarter, which means that government shutdown fears weren’t the main driver of recent yield increases. That was also despite economic activity in the manufacturing sector contracting in September for the 11th consecutive month following a 28-month period of growth, per the latest Manufacturing ISM report. PMI did exceed both expectations and August’s reading. The report will be construed as an economy tracking more for a soft landing than a hard landing at this juncture. Total construction spending increased 0.5 percent month-over-month in August, as expected. On a year-over-year basis, total construction spending was up 7.4 percent.

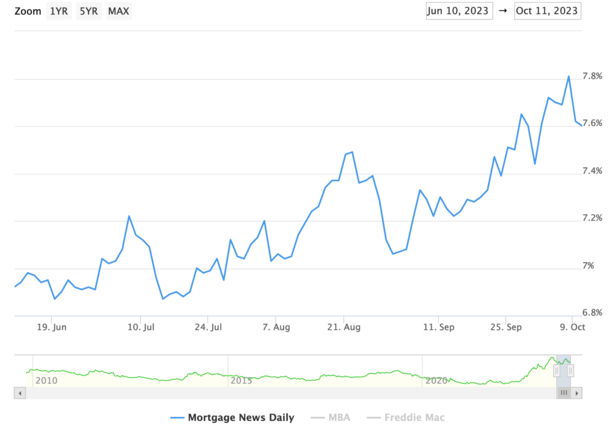

There was increased talk over the last week as to whether a “soft landing” will be achieved as the elevated inflationary environment experienced over the last two years subsides. New home sales declined to a worse than expected 8.7 percent in August as the recent move in interest rates towards 8 percent moves potential buyers to the sidelines. Builders have been able to take advantage of low inventory this year, however the recent home builder survey from the NAHB reported buyer traffic at a seven-month low in September. This has increased the number of builders offering discounts to 32 percent, the highest share since December 2022.

Meanwhile consumer confidence fell for the second straight month as consumers weighed the effects of rising food and gas prices, higher interest rates, and generally persistent elevated inflation. It is possible that consumers may finally start to pull back on spending as labor market growth slows, interest rates remain higher for longer, savings dwindle, and student loan payments resume.

Today’s economic calendar gets under way with remarks from Atlanta Fed President Bostic, and will be followed by Redbook same store sales, JOLTS job openings for August, and the latest monetary policy decision from the RBA. We begin the day with Agency MBS prices worse .125-.250 and the 10-year yielding 4.73 after closing yesterday at 4.68 percent.

LO Job Openings

A team of warehouse experts seeks an operations leader, with 5 plus years of experience managing internal warehouse operating platforms. This is a ground floor opportunity to launch and build a national warehouse lending business. If interested in this COO role, please send your confidential resume to Anjelica Nixt and specify this opportunity.

In the Northwest and California, Banner Bank is searching for Mortgage Loan Officers looking to create lasting Realtor and builder relationships at a bank focused on the market today. Banner has opportunities for lenders looking for local decision making with FHA, VA, USDA, state bond and true Portfolio lending opportunities along with servicing retained Fannie and Freddie loans to assist in client retention. Additional highlighted products cover CRA lending with private label no payment down payment assistance to help assist all borrowers with the right opportunity. Banner is the right fit for an established team, or the individual looking to grow their business and take the next step in their career. Please send resumes to Aaron Miller.