Apache is functioning normally

Advertisement

SKIP ADVERTISEMENT

Supported by

SKIP ADVERTISEMENT

A Huge Number of Homeowners Have Mortgage Rates Too Good to Give Up

On a scale not seen in decades, many Americans are stuck in homes they would rather leave.

Emily Badger and

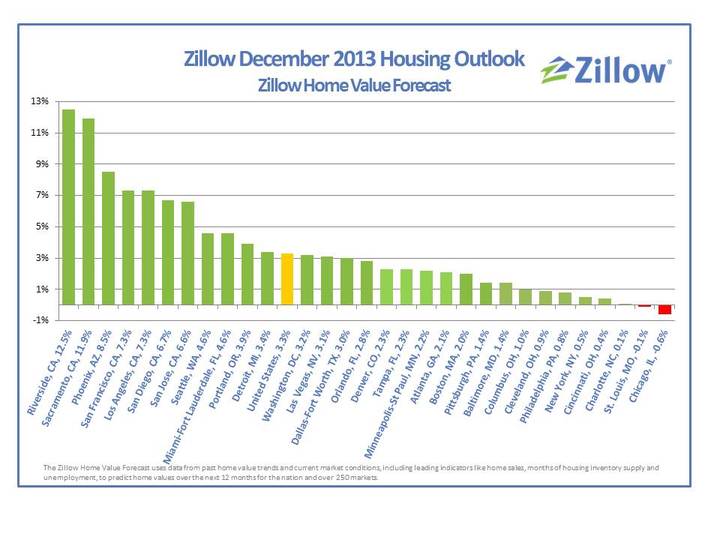

Something deeply unusual has happened in the American housing market over the last two years, as mortgage rates have risen to around 7 percent.

Rates that high are not, by themselves, historically remarkable. The trouble is that the average American household with a mortgage is sitting on a fixed rate that’s a whopping three points lower.

#g-mortgage1-box,

#g-mortgage1-box .g-artboard

margin: 0 auto;

#g-mortgage1-box p

margin: 0;

#g-mortgage1-box .g-aiAbs

position: absolute;

#g-mortgage1-box .g-aiImg

position: absolute;

top: 0;

display: block;

width: 100% !important;

#g-mortgage1-box .g-aiSymbol

position: absolute;

box-sizing: border-box;

#g-mortgage1-box .g-aiPointText p

white-space: nowrap;

#g-mortgage1-375

position: relative;

overflow: hidden;

#g-mortgage1-375 p

font-family: nyt-franklin, arial, helvetica, sans-serif;

font-weight: 300;

line-height: 18px;

opacity: 1;

letter-spacing: 0em;

font-size: 15px;

text-align: left;

color: rgb(0, 0, 0);

text-transform: none;

padding-bottom: 0;

padding-top: 0;

mix-blend-mode: normal;

font-style: normal;

height: auto;

position: static;

#g-mortgage1-375 .g-pstyle0

font-weight: 700;

line-height: 20px;

height: 20px;

font-size: 17px;

top: 1.4px;

position: relative;

#g-mortgage1-375 .g-pstyle1

line-height: 16px;

height: 16px;

font-size: 13px;

top: 1px;

position: relative;

#g-mortgage1-375 .g-pstyle2

font-weight: 500;

line-height: 15px;

height: 15px;

font-size: 13px;

color: rgb(137, 137, 137);

top: 1px;

position: relative;

#g-mortgage1-375 .g-pstyle3

line-height: 16px;

#g-mortgage1-375 .g-pstyle4

font-weight: 500;

line-height: 15px;

height: 15px;

font-size: 13px;

top: 1px;

position: relative;

#g-mortgage1-375 .g-pstyle5

line-height: 16px;

height: 16px;

opacity: 0.87;

font-size: 13px;

top: 1px;

position: relative;

#g-mortgage1-850

position: relative;

overflow: hidden;

#g-mortgage1-850 p

font-family: nyt-franklin, arial, helvetica, sans-serif;

font-weight: 300;

line-height: 23px;

opacity: 1;

letter-spacing: 0em;

font-size: 17px;

text-align: left;

color: rgb(0, 0, 0);

text-transform: none;

padding-bottom: 0;

padding-top: 0;

mix-blend-mode: normal;

font-style: normal;

height: auto;

position: static;

#g-mortgage1-850 .g-pstyle0

font-weight: 700;

font-size: 19px;

#g-mortgage1-850 .g-pstyle1

line-height: 16px;

height: 16px;

font-size: 13px;

top: 1px;

position: relative;

#g-mortgage1-850 .g-pstyle2

font-weight: 500;

line-height: 18px;

height: 18px;

font-size: 15px;

color: rgb(137, 137, 137);

top: 1.2px;

position: relative;

#g-mortgage1-850 .g-pstyle3

line-height: 16px;

height: 16px;

font-size: 13px;

text-align: center;

top: 1px;

position: relative;

#g-mortgage1-850 .g-pstyle4

line-height: 17px;

font-size: 15px;

#g-mortgage1-850 .g-pstyle5

font-weight: 500;

line-height: 18px;

font-size: 15px;

Average fixed mortgage rates

8%

Existing

mortgages

6%

3.2-

point

gap

Rates on

new loans

4%

Rates on new home loans now far surpass rates locked in by Americans with existing

mortgages.

2%

2000

2005

2010

2015

2020

2023

Average fixed mortgage rates

8%

Existing

mortgages

6%

3.2-

point

gap

Rates on

new loans

4%

Rates on new home loans now far surpass rates locked in by Americans with existing

mortgages.

2%

2000

2005

2010

2015

2020

2023

Source: Federal Housing Finance Agency analysis. Note: New loan figures show the predicted rate that existing mortgage holders could get on the same mortgages at new market conditions.