Apache is functioning normally

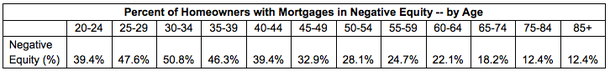

People have been screaming about a housing bubble crash on social media sites for over 12 years. The truth is, U.S. housing credit looks very different than in 2005, 2006, 2007 or 2008. Homeowners have actually never looked better and the data from the Federal Reserve‘s Quarterly Report on Household Debt and Credit shows why.

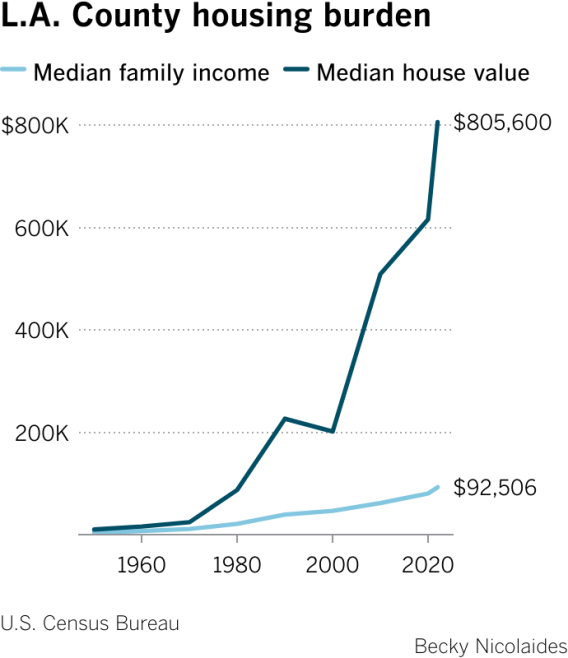

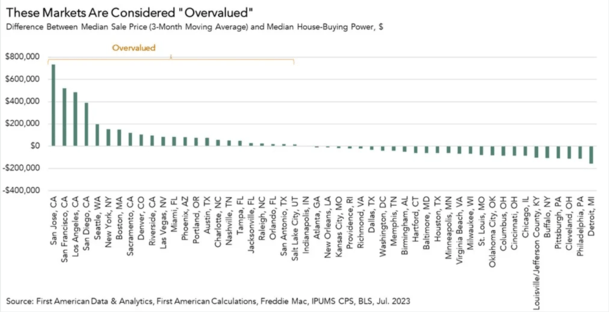

Homeowners are not the people we need to be concerned about this time. Renters, younger renter households and those with lower FICO scores are the ones showing credit stress today. Homeowners, on the other hand, are sitting pretty and are the envy of the world.

Bankruptcies and foreclosures

After 2010, the qualified mortgage laws came into play and all the exotic loan debt structures in the system, especially in the run-up in demand from 2002 to 2005, disappeared. This means housing should only show financial stress when people lose their jobs and cannot pay their mortgages — not because the loan structures are a ticking time bomb.

As shown below, we saw massive credit stress in the data from 2005 to 2008, all before the job loss recession happened. It was there for everyone to see and read. Now, that same chart shows that homeowners don’t have credit stress. So, for those still saying housing is in a bubble: Where’s the beef?

From the report: About 40,000 individuals had new foreclosure notations on their credit reports, mostly unchanged from the previous quarter. New foreclosures have stayed very low since the CARES Act moratorium was lifted.

FICO score and cash flow

When I speak at events around the country and put up this chart, I always say, what a beautiful-looking chart! That’s because after 2010, people got 30-year fixed mortgages and every year, as their wages rose, their cash flow versus the debt cost of their home got better. Then add three refinancing waves in 2012, 2016 and 2020-2021, and you can see why homeowners are in a good spot.

During inflationary periods, wages grow faster than usual, so housing debt costs much less. Also, people live in their homes longer and longer as they age and their yearly income lowers their housing costs. One note on this subject: we had an explosion of households with FICO scores of 740+ during COVID-19. A lot of rookie economists said this was FICO score inflation. But the data has been the same since 2010: we just originated more loans during this time — purchases and refinances — so the data didn’t get better, it stayed roughly the same.

From the report: The median credit score for newly originated mortgages was flat at 770, while the median credit score of newly originated auto loans was one point higher than last quarter at 720.

Delinquency status

When the next job loss recession hits, we should all expect credit stress in housing to start rising. Every month, people get fired and can’t find work right away. This is why jobless claims are never zero and we have a constant amount of 30-60 days late every month. However, since we are working from near record lows in credit delinquency data and the homeowners’ households are in such good financial shape, the credit stress data won’t be like what we saw in 2008.

Over 40% of homes in America don’t even have a mortgage, and we have a lot of nested equity, so if worst comes to worst, many homeowners who bought homes from 2010-2020 have a ton of equity and can sell. Remember, the foreclosure process typically will take 9-18 months from start to finish, meaning that homes come to market as market supply due to the legal process we have in-housing. This is very unlike 2008, where we had four years of credit stress building up in the system.

From the report: Early delinquency transition rates for mortgages increased by 0.2 percentage point yet remain low by historic standards.

Hopefully, between the charts and the explanations, you can see why it’s not housing 2008. However, we do see credit stress in the data for younger households and those with lower FICO scores. The people that Jerome Powell says he wants to help at each meeting are showing credit stress.

The Fed missed the housing bubble credit stress when it was apparent in the run-up to 2008, and now they’re turning a blind eye to those who aren’t homeowners by keeping policy too restrictive, due to some devotion to a 1970s inflation model that doesn’t exist today. Or, as I’ve said since 2022, they’re old and slow. It’s the nature of the beast.

Related

Source: housingwire.com