*Rates and APYs are subject to change. All information provided here is accurate as of March 28, 2024.

Our writers and editors have invested thousands of hours analyzing and vetting lenders offering VA loans. Through exhaustive research, we’ve come up with a list of the best VA mortgage lenders for military members and their families, including Navy Federal, Rocket Mortgage and Veterans United. Read on for our Best VA loan lender reviews and a comprehensive lending guide on how to find and apply for a VA loan.

Money’s Main Takeaways

- VA loans are one of the main benefits the federal government offers to retired and active-duty members of the military

- Borrowers can qualify for a VA loan with a lower credit score and 0% down payment compared to conventional loans

- There is no private mortgage insurance, but borrowers will be required to pay a funding fee

- VA loans offer competitive interest rates compared to other loan options

Our Top Picks for Best VA Loan Lenders of April 2024

Best VA Loan Lenders Reviews

- Lowest fees on our list

- Non-VA mortgage options that require no down payment

- 356 branches worldwide

- No lender fees

- Small number of branches within the U.S.

- Membership strictly limited to military members, spouses, family members, veterans and the Department of Defense

- Customized rates only offered to members

HIGHLIGHTS

- Sample rate

- 5.750% (6.223% APR) on a 30-year fixed-rate purchase loan of $300,000

- Minimum credit score

- Unstated, VA recommendation of 620 is suggested

- Minimum down payment

- 0% for qualifying borrowers

- Availability

- Continental U.S.

- Pre-approval time

- Approximately 3 business days

- Mobile app

- Yes

- NMLS ID

- 399807

Why we chose it: A combination of low lender fees, several loan assistance programs and a wide selection of mortgage loans make Navy Federal Credit Union our best VA loan lender overall.

Navy Federal Credit Union offers military families low rates on financial products, such as personal loans, auto loans and credit cards. The credit union’s VA home loan program features a fast pre-approval process and loan options with no down payment. No PMI is required, either. Navy Fed also recently introduced its no-refi rate drop, where you could qualify for an interest rate reduction without going through the refinancing process.

Additionally, Navy Federal’s Shop & Lock feature allows you to lock in your rate for up to 60 days while you shop for a home, plus an additional 60-day lock once you’ve submitted a purchase agreement. Other perks include up to $9,000 cash back for working with a real estate agent at RealtyPlus, the credit union’s real estate service and a rate match guarantee where Navy Federal will match a better rate offered by another lender or give you $1,000 if all qualifying conditions are met.

Membership is required to use Navy Federal’s services. All active duty, retired and veteran service members of all armed forces branches — plus their families, immediate relatives and some household members — are eligible. Membership is also open to Department of Defense civilian personnel. To become a member, you simply open a savings account with a minimum of $5.

- Access to your loan information is available 24/7 with the proprietary mobile app

- Credit scores as low as 580 accepted

- Debt-to-income ratios as high as 60% accepted

- No HELOCs offered

- No USDA loans offered

- No physical locations for in-person service

HIGHLIGHTS

- Sample rate

- 5.99% (6.429% APR) with 2.125 points purchased ($5,843.75) on a purchase loan of $275,000

- Minimum credit score

- 580

- Minimum down payment

- 0% for qualifying borrowers

- Availability

- All 50 U.S. states

- Pre-approval time

- 10-15 minutes

- Mobile app

- Yes

- NMLS ID

- 3030

Why we chose it: Rocket Mortgage’s (formerly Quicken Loans) fully online application and closing process, along with its multiple tools for keeping track of your in-process and existing loans make it our pick for best online VA loan lender.

Rocket Mortgage is an online lender that stands out for its relatively seamless online mortgage application process. While the experience may vary depending on each borrower’s situation, Rocket Mortgage’s website and mobile app allow you to submit all of your paperwork digitally and track every step of your loan’s processing.

While you have the option of speaking with a live representative, you can also communicate with Rocket Mortgage through online or mobile messaging.

Although Rocket Mortgage doesn’t have the broadest loan offering, it does work with all the major VA loans (purchase, refinance, IRRRL) and considers credit scores as low as 580 and debt-to-income ratios as high as 60%. Borrowers buying a home through Rocket Homes and financing through Rocket Mortgage could get a 1.25% closing credit, up to a maximum of $10,000.

For more detailed information, read our full review of Rocket Mortgage (Quicken Loans).

- Broader selection of veteran-focused loans than competitors

- Offers real estate services for veterans

- Customer support is available 24/7

- No HELOC products offered

- Only 26 affiliate branches across 17 states

HIGHLIGHTS

- Sample rate

- 5.875% (6.307% APR) with 1.5630 points purchased ($4,610.85) on a 30-year fixed-rate purchase loan of $295,000

- Minimum credit score

- 600

- Minimum down payment

- $0 for qualifying borrowers

- Availability

- All U.S. states

- Pre-approval time

- Not stated

- Mobile app

- Yes

- NMLS ID

- 1907

Why we chose it: Veterans United offers more veteran-focused mortgage options than the standard purchase, refinance and streamline products, making it our choice for best VA loan lender for VA loan variety.

Veterans United guarantees more loans than any other VA-approved lender, according to The Department of Veterans Affairs. The VA compiles a list each month of the top lenders, and Veterans United Home Loans hasn’t budged from its number-one spot in more than six months.

In addition to its reasonable qualifying credit score and income requirements, Veterans United offers a wide variety of loan types: purchase, refinance, IRRRL (streamline) VA loans, Jumbo VA loans, VA energy-efficient mortgages and VA cash-out refinance loans.

Jumbo VA loans can be a good option for veterans who no longer have their full VA entitlement, which means that their VA loans have a limit placed on the total amount borrowed (unlike veterans with full entitlement). Energy-efficient mortgages are not common to VA loans and are a good option for anyone looking to add energy-efficient improvements to their new home.

- Second-lowest fees of any lender we’ve reviewed

- Loan amounts up to $1 million

- No PMI insurance required

- Alternative or non-traditional credit and income data not considered for loan applications

- Funding fee required

HIGHLIGHTS

- Sample rate

- 5.75% (6.024% APR) with 1.125 points purchased on a 30-year fixed-rate purchase loan of $450,000

- Minimum credit score

- 620

- Minimum down payment

- 0% for qualifying borrowers

- Availability

- All U.S. states

- Pre-approval time

- Within three business days

- Mobile app

- Yes

- NMLS ID

- 401822

Why we chose it: PenFed currently offers the lowest mortgage rate for a 30-year fixed-rate loan, which makes it our pick for the best VA loan lender for competitive rates.

When it comes to VA loans and mortgages, PenFed Credit Union stands out for offering some of the lowest rates across the board on conventional, FHA, VA, Jumbo and adjustable-rate mortgages. Eligible borrowers may qualify for zero down payment. Additionally, PenFed doesn’t require borrowers to acquire private mortgage insurance (PMI).

You must be a member of PenFed to use PenFed’s VA loan services, but joining is an easy process: Simply open a savings account at the credit union with a minimum of $5.

For more detailed information, read our full review of Penfed.

- Accepts credit scores as low as 600

- Variety of mortgage products available

- Self-employment and nontraditional income accepted

- Physical branches only in Missouri

- Other fees apply

HIGHLIGHTS

- Sample rate

- 6.625% (6.864% APR) on a 15-year fixed-rate purchase loan of $300,000

- Minimum credit score

- 600

- Minimum down payment

- 0% for qualifying borrowers

- Availability

- All U.S. states

- Pre-approval time

- Not stated

- Mobile app

- Yes

- NMLS ID

- 400039

Why we chose it: North American Savings Bank is dedicated to servicing customers in the Kansas City, MO area, but it extends its mortgage services to individuals all over the U.S. Notably, NASB works with borrowers with credit scores as low as 600, lower than what other many lenders allow.

No origination fees are charged on VA loans from NASB, but a VA loan funding fee may be required. Many loans don’t require a down payment, either. NASB offers a loan payment calculator on its site where borrowers can see potential VA home loan rate scenarios.

In addition to standard VA loan products (purchase, IRRRL, cash-out refinance), North American Savings Bank offers the widest variety of mortgage options for individuals who are unable to provide “traditional” credit and income data, such as people who are self-employed.

- VA Cash-out refinance, IRRRL and Jumbo IRRRL available

- Discounts for bundling services (e.g. home and auto insurance)

- Variety of discounts through USAA Perks (car rental, travel, shopping)

- Requires membership in USAA

- No home equity loans or lines of credit

HIGHLIGHTS

- Sample rate

- 6.125% (6.447% APR) with 0.801 points purchased for a fixed-rate purchase loan and 5.875% (6.196% APR) with 0.933 points purchased for a VA Jumbo purchase loan

- Minimum credit score

- 620

- Minimum down payment

- 0% for qualifying borrowers

- Availability

- All U.S. states

- Pre-approval time

- Not disclosed

- Mobile app

- Yes

- NMLS ID

- 401058

Why we chose it: For those looking to refinance their existing VA loan, USAA offers all of the possible options with competitive rates and terms.

USAA stands out as a VA loan refinance leader for offering all the available options: VA Interest Rate Reduction Refinance Loans (IRRRL), VA Jumbo Interest Rate Reduction Loans, VA Cash-Out Refinance Loans and Jumbo VA Cash-Out Refinance Loans. With either cash-out refinance, you can refinance up to 90% of your home’s value. With IRRRLs, you can refinance up to 100%.

However, rates at USAA aren’t the lowest among the lenders in our top picks. Still, the company’s rates are within the typical range for the market and the option to finance your VA funding fee into your total loan amount is available with all four refinance types.

USAA offers additional financial products and services, such as insurance, banking and investing. All of its products are available only to members. Military members, veterans, their spouses, children, and pre-commissioned officers are eligible.

Members also get discounts for bundling (e.g. home and auto insurance) as well as discounts on car rentals, travel packages, home security, moving services, select retailers and more.

*USAA does not disclose the credit score, loan amount or down payment of its advertised rates. To get a better estimate of your potential monthly payment, use the USAA VA Home Loan Mortgage Payment Calculator.

- Allows you to compare multiple mortgage lenders’ rates at the same time

- Over 1,500 partnered lenders in its network

- Offers credit monitoring tools

- Limited contact options

- Customer support does not address issues with the lender of your choice

- Does not service loans

HIGHLIGHTS

- Minimum credit score

- Varies by lender

- Minimum down payment

- Varies by lender

- Availability

- Varies by lender

- Pre-approval time

- Varies by lender

- Mobile app

- Yes

- NMLS ID

- 1136

Why we chose it: LendingTree is an online marketplace that allows you to compare rates on multiple products, from mortgages to personal loans and even credit cards, making it our pick for the best marketplace for comparing VA loan rates.

LendingTree stands out from its competition due to its more than 1,500 partnered mortgage lenders and easy-to-use mobile app.

Borrowers can request multiple quotes (up to three at the same time), which include projected rates and closing costs all in one place. It is also free to use and doesn’t impact your credit score.

The only notable downside to LendingTree’s services is that the company is not a loan servicer or originator, meaning that its customer support will not handle most issues that may come up during your loan process.

LendingTree does not provide sample rates for VA loans specifically. However, you can use the online marketplace’s mortgage comparison tool to check potential rates.

For more details read our full review of Lending Tree.

- Minimum credit score is 580

- “I CAN” loan offers customizable loan terms

- Buydown option to lower interest rate for first 1-3 years

- No interest rate or APR info publicly available

- Must enter contact info to get rate estimates

HIGHLIGHTS

- Sample rate

- 6.250% (6.563% APR) with 3 points purchased on a 30-year fixed-rate for a purchase loan of $726,200

- Minimum credit score

- 580

- Minimum down payment

- 0% for qualifying borrowers

- Availability

- All 50 U.S. states

- Pre-approval time

- Within 24 hours

- Mobile app

- Yes

- NMLS ID

- 6606

Why we chose it: New American Funding is our top pick for low credit score requirements for VA loans. While its 580 minimum credit score requirement is not unique on the list, it has a vast selection of mortgage loans. Beyond the VA Purchase Loan, there’s also a VA Native American Direct Loan, VA Energy Efficient Mortgage, VA Streamline Refinance Loan and VA Cash-Out Refinance.

Notably, it offers what NAF refers to as an “I CAN” loan, which allows you to choose a custom fixed loan term between eight and 30 years. It also offers a “buydown mortgage” option for VA loans, which allows borrowers to reduce the interest rate on their mortgage for the first one to three years of their loan.

To get a quote, you must contact a representative online or by phone, which requires providing personal information — first and last name, email address and phone number.

For more detailed information, read our full review of New American Funding.

- Over 400 branches across 48 states

- Accepts credit scores as low as 580

- Offer specialized mortgages for physicians

- No branches in Alaska or West Virginia

- Rates not disclosed unless you call or submit an online form requesting a callback

- Phone customer service hours (M-F, 8:30 am-5 pm CST) may be too restrictive for some

HIGHLIGHTS

- Sample rate

- Unavailable

- Minimum credit score

- 580

- Minimum down payment

- 0% for qualifying borrowers

- Availability

- Licensed in all 50 U.S. states; in-person service available in ll U.S. states except Alaska and West Virginia

- Pre-approval time

- Undisclosed

- Mobile app

- Yes

- NMLS ID

- 2289

Why we chose it: Fairway Independent Mortgage’s presence in 48 out of 50 U.S. states makes it our top pick for in-person mortgage loan servicing.

Fairway Independent Mortgage is notable for its many branches across all but two U.S. states (Alaska and West Virginia), making it an ideal choice for individuals who prefer in-person service. The company offers VA mortgage loans with 100% financing if you have full VA entitlement.

A down payment will be required if you don’t have full VA entitlement or the loan exceeds the VA county limits. Like other VA loan lenders, Fairway Independent Mortgage also considers factors such as credit score and income when determining loan terms.

Fairway also offers a broad range of mortgage products which can be helpful for those who are unable to qualify for a VA loan. Among these loan products are specialized physician loans aimed at medical professionals still working through repaying their student loans.

For more detailed information, read our full review of Fairway Independent.

Ads by Money. We may be compensated if you click this ad.Ad

Other VA loan lenders we considered

While there are many mortgage lenders with outstanding products and features, they don’t necessarily have everything that could make them one of our top picks.

We reviewed the following lenders, and while they meet some of our criteria for “Best VA home loan lenders” (low rates, VA loan experience, good customer service), they ultimately didn’t make the cut.

Freedom Mortgage

- 550 credit score minimum is the lowest on our list

- Fully online loan process

- Variety of calculators and educational resources on their site

- Rates are only provided by calling for an estimate or signing up for online alerts

- High number of CFPB complaints

- Does not offer HELOCs

Why Freedom Mortgage didn’t make the cut: The lender has over 2,800 complaints lodged with the Consumer Financial Protection Bureau since March 2021. The Better Business Bureau has received over 1,200 complaints about the lender in the last three years and its accreditation was revoked.

Freedom Mortgage is a fully online lender that offers standard mortgage products such as conventional purchase and refinance loans, FHA, VA and USDA loans. What makes it stand out is its credit score requirement of 550 for VA loans, which is the lowest of any lender we considered.

Veterans First

- Fully online loan process, helpful for military members deployed overseas

- Educational resources

- Specializes in VA loans

- Higher credit score requirements than any lenders we’ve reviewed (mid-600s)

- Offers no home equity loans

- No rate information on its website

Why Veterans First didn’t make the cut: The higher-than-average credit score requirement (mid-600s) was a deciding factor in keeping it out of our top list.

Thanks to its fully online mortgage process, Veterans First (NMLS ID 449042) is a great choice for military members deployed overseas. Its focus on VA loans also means that the company is better prepared to attend to the specific needs of military members and veterans during the mortgage process.

Paramount Bank

- Origination fees waived for VA loans

- No prepayment penalties for VA loans

- No fee or rate information on its website

- No information on loan requirements on its website (minimum credit score, DTI, etc.)

Why Paramount Bank didn’t make the cut: Its general lack of upfront information about rates, fees and credit score requirements kept it out of our top lenders.

Paramount Bank (NMLS ID 551907) waives the lender’s origination fee ($1095) on all of its VA loans, making it an option worth considering. There are no prepayment penalties, either.

Flagstar Bank

- Considers credit scores as low as 580 for VA loans

- Collaborates with down payment assistance and other special mortgage programs

- Large selection of mortgage products for those who don’t qualify for a VA loan

- Branches located in only 28 states

- $75 annual fee for home equity line of credit (HELOC) loans

- High number of complaints with CFPB in the last three years (1,000+)

Why Flagstar Bank didn’t make the cut: Flagstar’s lack of branches in almost half of the U.S. and limited rate and fee information on its website kept it out of our top picks. For more details, read our full review of Flagstar Bank.

Flagstar Bank (NMLS ID 417490) is a notable mortgage lender thanks to its wide variety of mortgage loans offered and its collaboration with several special mortgage programs such as down payment assistance and home loan grants.

PNC

- Mortgage rate calculator allows for scenarios with credit scores as low as 620

- Individuals with credit scores under 620 may be offered alternative loan options

- Mortgage rates are only slightly above average (~0.2%)

- Relatively small selection of loan products

- No specialized VA loans

- Contact information and branch locations are not easy to locate

Why PNC didn’t make the cut: While full details aren’t available without speaking to an agent, PNC’s rate calculator shows rates slightly higher than many of our top picks.

PNC (NMLS ID 446303) has a standard offering of mortgage products, including conventional, FHA, VA, refinance and HELOC loans. PNC only offers a partially online loan application process. You can perform a digital income and asset verification, but you must speak with a loan officer to go over your loan details.

LoanDepot

- Strong focus on digital mortgage processing allows a fully online mortgage experience

- Over 200 affiliate branches nationwide

- Credit score minimums and loan eligibility criteria are not disclosed upfront

- Relatively small loan offering

- No HELOCs offered

Why LoanDepot didn’t make the cut: Its website doesn’t disclose credit score and other loan eligibility requirements. For more details, read our full review of LoanDepot.

LoanDepot (NMLS ID 174457) is a primarily online mortgage loan lender with several affiliate branches across the U.S. Its loan products include conventional purchase mortgages, FHA, VA, ARM (adjustable-rate) and 203k (FHA home renovation) loans. LoanDepot’s digital income and assets verification tools can significantly speed up the loan approval process in some cases.

Guild Mortgage

- Broad mortgage loan offering, including energy-efficient home mortgages

- Accepts down payment assistance programs

- Services its own loans

- Rates are only disclosed after reaching out to Guild

- No branches in IN, KY, MI, MN, MS, NY, or WV

Why Guild Mortgage didn’t make the cut: No rate information is publicly available; you must contact Guild for details. For more information, read our full review of Guild Mortgage.

Guild Mortgage (NMLS ID 3274) offers a variety of mortgage options beyond VA loans, including bridge mortgages that can help you sell your current home while shopping for a new one and energy-efficient mortgages.

Guild is also a good choice for people who prefer in-person service, since they have branches in all but seven U.S. states. Notably, Guild services its loans, which is something that not all mortgage loan originators do.

Guaranteed Rate

- Housing market research tool available

- Home valuation tool available

- Credit scores as low as 580 accepted for VA loans

- Conventional mortgage rates are higher than average (around 0.7% higher)

- Limited offering of VA loan products

Why Guaranteed Rate didn’t make the cut: Its VA loan product offerings are limited.

Guaranteed Rate (NMLS ID 2611) is a mortgage lender that allows borrowers to fully process their loan applications online, from start to finish. Individuals who prefer in-person service can also go to one of its 500+ locations across 46 states.

Movement Mortgage

- Offers several high-balance mortgage products (jumbo loans)

- Considers credit scores as low as 580 for VA loans

- Down payment assistance options available

- Streamlined underwriting process that can close loans in as little as a week

- Mortgage rates can only be obtained after contacting Movement

- No 24/7 customer service

- No physical locations

Why Movement Mortgage didn’t make the cut: Rate information isn’t publicly available to potential borrowers; you must contact the company for details. For more information, read our full review of Movement Mortgage.

Movement Mortgage (NMLS ID 39179) is an online mortgage lender that claims to be able to fully close on a loan in under two weeks, though these results will depend on each borrower’s situation. Notably, Movement considers credit scores as low as 580 for VA loan applications, well under the VA’s suggested 620.

Besides its VA loan products, Movement also has several down payment assistance and high-balance mortgage options, which are helpful for individuals looking to purchase in high cost-of-living areas.

NBKC Bank

- Provides nationwide mortgage service, despite being a regional bank

- Mortgage rate calculator allows credit scores in the 300s

- Offer specialized mortgages for pilots

- Only four branches split between Kansas and Missouri

- Mortgage rates can be as much as 1.5% higher than our top picks

- Mortgage rate calculator is not easy to access

Why NBKC Bank didn’t make the cut: Its VA loan rates are a bit higher than those of our top picks. For more details, read our full review of NBKC.

NBKC Bank (NMLS ID 409631) is a Kansas/Missouri regional bank that extends its mortgage services nationwide. While its loan offerings are standard (conventional, FHA, VA), it offers specialty home loans for pilots.

Notably, it is one of the few lenders that allows customers to obtain mortgage rates for credit scores under 500, although you’re not guaranteed results below that threshold. Its mortgage rates are also considerably higher than average (up to 1.5% higher).

VA Loans Guide

A VA loan is a home loan issued by private lenders and backed by the U.S. Department of Veterans Affairs (VA). Read on to learn more about VA home loans, their pros and cons, the associated costs and how to apply.

How does a VA loan work?

VA loans are one of the main benefits the government provides to active duty and retired members of the armed forces. Eligibility will depend on the borrower’s years of service. There are also property requirements that must be met. Read more on VA loans to find full details and see how a VA loan can help you achieve your homeownership goal.

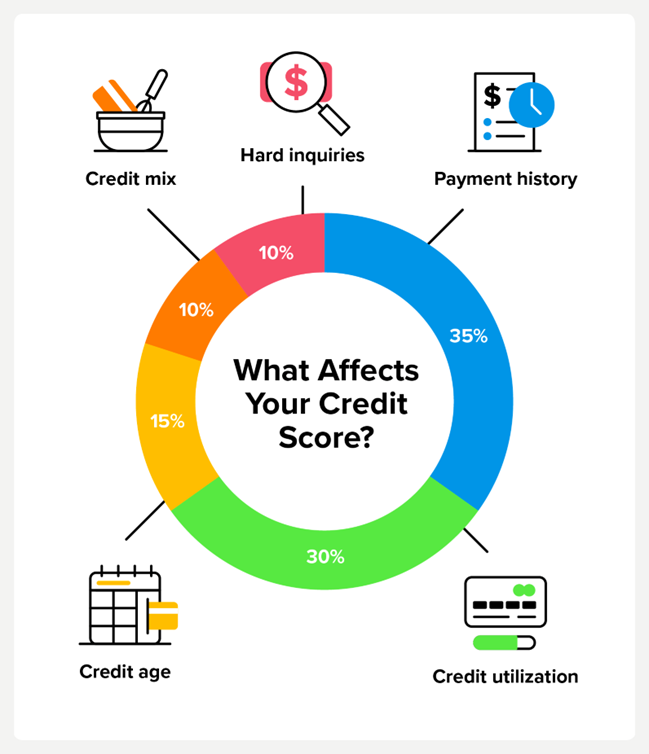

Beyond military service requirements, some VA loan lenders require specific standards of creditworthiness. These details will vary by lender, but can include a credit score of 620 or higher and a debt-to-income ratio of 41% or less. (You can calculate your specific percentage using our debt-to-income ratio calculator.)

VA loans offer two big advantages for qualifying homebuyers. There is no required down payment, and the mortgage rates tend to be lower than those on conventional mortgages or FHA loans. Both of these features make a VA loan a more affordable financing option, especially for first-time homebuyers.

The VA no longer places maximum loan limits, but your VA mortgage lender might. In most U.S. counties, the maximum loan amount for 2024 is $766,550, but it can be as high as $1,149,825 in more expensive areas. Jumbo loans will have a higher limit.

Types of VA loans

The U.S. Department of Veterans Affairs offers four different types of mortgages — VA purchase loan, interest rate reduction refinance loan (IRRRLs), cash-out refinance loan, and Native American direct loan — each with its own set of requirements and limitations. Evaluate all loan options before deciding which best VA mortgage lender suits your needs.

Purchase loan

Purchase loans are used to finance the buying of a primary residence, make energy-efficient upgrades to an existing home or buy property to build a house. They cannot be used to buy investment properties, vacation homes, rental properties or fixer-uppers in need of significant repairs.

To learn more, read our guide on VA purchase loans.

Interest Rate Reduction Refinance Loan (IRRRL)

Designed to refinance an existing VA mortgage, a streamlined refinance can get you a lower interest rate, reduce the loan term, or go from a variable-rate to a fixed-rate mortgage.

Cash-out refinance loan

A VA cash-out refinance allows you to access the equity you’ve built up in your home by applying for a new mortgage with a higher balance. The proceeds of the new loan will pay off your old mortgage and you’ll receive the excess amount in the form of a lump sum payment.

Learn more about how to tap into your home equity with a VA cash-out refinance or read our guide on on how to refinance a VA loan to get more information on refinancing.

Native American Direct Loan (NADL)

NADL is the only VA loan managed and funded directly by the government entity. Veterans who are Native American (or whose spouses are Native American) are eligible for this loan. Borrowers can use this loan to buy, build, or improve a home on federal trust land.

As of this writing, there is no limit to the amount of money that can be borrowed with this program (aside from the limitations imposed by creditworthiness, DTI, and general Fannie Mae/Freddie Mac conforming limits, though borrowers can access higher limits if they choose to make a down payment).

Additional VA-backed loan programs

VA Energy Efficient Mortgage (EEM)

Finance energy efficient home improvements, such as a solar water heater, solar panels, storm doors on windows and furnace efficiency modifications, through an EEM. Ineligible home upgrades include A/C units, vinyl siding and new roofing or shingles.

VA renovation loan

Also called a VA rehab loan or a reno loan, a VA renovation loan is a way to include the cost of home repairs and improvements in your VA home loan amount. No luxury upgrades are allowed. This loan is intended for repairs such as heating and cooling system replacement, upgrades to make the home more accessible for people with disabilities and the replacement of old appliances.

VA loans for manufactured homes

You can get financing for a manufactured home, also known as a mobile home or a modular home. However, there is a 25-year maximum loan term on larger units, and a 20-year loan term limit on smaller units. Lender credit requirements for VA mobile home loans may also be higher than loans for conventional homes. The mobile home must also have a permanent foundation and comply with safety standards set by the U.S. Department of Housing and Urban Development (HUD).

To explore other home loan options or check out current mortgage rates, our page of the best mortgage lenders can be an excellent place to start.

There are specific requirements you must meet to qualify for a VA home loan.

Ads by Money. We may be compensated if you click this ad.Ad

How to qualify for a VA Loan

There are specific requirements you must meet to qualify for a VA home loan.

The VA home loan program and its military benefits are available for:

- Active-duty military members

- Veterans

- Past and present members of the National Guard

- Surviving spouses of military personnel who died in combat

A VA home loan does not have a minimum credit score requirement, but most participating VA loan lenders require a minimum credit score of 620. Our advice? Always check your credit report and debt-to-income ratio before applying for a loan and improve it if you can. (Be sure to read our guide on how to dispute your credit report.)

Service requirements

VA loan eligibility depends on the length of service of the applicant. These are the requirements as set by the VA:

- Veterans and active-duty service members must have served at least 90 days during wartime or 181 days during peacetime.

- National Guard members must have served at least 90 days of active-duty service during wartime or six years of creditable service in the Select Reserves or Guard.

- Two kinds of discharges from military service may affect eligibility determination: Other Than Honorable (OTH) and Bad Conduct.

- The specific circumstances of a veteran’s discharge will be considered, which could take Veterans Affairs (VA) months to evaluate.

In all cases, once deemed eligible, you must apply for a Certificate of Eligibility (COE). The COE proves to the VA mortgage lender that you meet the VA’s eligibility requirements.

How to apply for a VA home loan

After confirming eligibility for a VA loan, take the following steps to apply:

- Shop around for a lender and compare rate quotes before settling on the one that best fits your needs.

- Submit your loan application. The lender will request a VA appraisal of the house. The lender reviews the appraisal, your credit history and income and decides if it accepts your loan application.

- Apply for your COE and contact your state’s regional VA loan center to start the process directly with the government, in the case of Native American Direct Loans.

Once your lender accepts your application, they’ll work with you to select a title company (or entity) to close on the house.

If you have any questions that your lender can’t answer, please call your VA regional loan center at 877-827-3702. You can also watch a video on the official U.S. Dept. of Veteran Affairs’ YouTube page to learn more about VA home loans and how to apply.

How to get a VA loan with bad credit

Some lenders will issue a VA loan to veterans and service members with credit scores as low as 580 or lower. Freedom Mortgage, for example, will accept a credit score as low as 550. However, most lenders will require a minimum credit score of 620.

If you don’t meet the minimum credit score required, you should work on improving your personal finances. Paying the bills on time, paying off any debt you currently have and contacting the reporting agency to fix any errors are some steps that can help improve your score.

More About VA Mortgage Loans

Best VA Loan Lenders FAQs

What is a VA home loan?

chevron-down

chevron-up

A VA loan is a no-down-payment mortgage military benefit partially backed by the Department of Veterans Affairs (VA). Borrowers can use the loans for the purchase of a primary residence or to refinance an existing mortgage.

Who qualifies for a VA loan?

chevron-down

chevron-up

To qualify for a VA loan, you or your spouse must meet the basic service requirements set by the Department of Veterans Affairs (VA), have a valid Certificate of Eligibility, and meet the lender’s income and credit requirements.

How many times can you use a VA loan?

chevron-down

chevron-up

You can use a VA loan more than once but only to purchase or refinance a principal residence, provided you meet the availability requirements. However, you may be able to use a partial entitlement for a second loan if you haven’t used it all on your first mortgage. Remember that using a partial entitlement may mean you’ll need to shell out a down payment and a higher VA funding fee.

Are VA loans assumable?

chevron-down

chevron-up

Because VA loans are backed by the U.S. government, they can be assumed by a new lender even if they are not active military or veterans. In order to assume a VA loan, the new borrower must have a minimum credit score of 580, a DTI of 45% or lower, pay the VA funding fee and ensure the home will be their primary residence. In some cases, a down payment may also be required.

How long does it take to close a VA loan?

chevron-down

chevron-up

VA loans typically take a little longer than a traditional mortgage loan to close. Although the experience may vary from one person to another, VA loans take about 50 to 55 days to close on average. However, it is possible to close on a VA in as little as 30 days in some cases.

Does a VA loan require mortgage insurance?

chevron-down

chevron-up

No, VA loans do not require private mortgage insurance or any other type of mortgage insutance that is required by other loan types, such as conventional and FHA loans. The lack of an insurance requirement is one of the main benefits of obtaining a VA loan, along with not having to make a down payment.

Do VA loans have closing costs?

chevron-down

chevron-up

Yes, VA loans have closing costs, which can amount to 3% to 6% of the loan amount. These costs include fees associated with the loan origination and underwriting, title insurance and recording fees and the VA appraisal fee, among others. The VA funding fee, which ranges between 1.25% and 3.3% of the loan amount, is also due at closing but can be rolled into the loan. The home seller can pay up to 4% of the closing costs on a VA loan.

How We Chose the Best VA Loan Lenders

Given that many mortgage lenders offer similar products across the board, we narrowed our search criteria to three factors: rates, experience and customer service.

- Rates – We chose VA loan lenders that offered the lowest rates to ensure your mortgage payments fall in line with your budget.

- Experience in VA Loans – We prioritized VA mortgage lenders that process many VA loans. Having a VA mortgage lender who is familiar with this process ensures that every step of your home purchase is taken care of on time.

- Customer Service – We highlighted VA mortgage lenders that excel in customer satisfaction and provide first-time homeowners step-by-step guidance throughout the pre-approval, application and loan closing.

We also made sure that our picks are registered with the Nationwide Multistate Licensing System and Registry (NMLS) and meet the minimum certification requirements for mortgage lending.

Though we always try to include accurate and up-to-date information on regulatory and legal actions, we don’t claim this information is complete or fully up to date. Interest rates and annual percentage rates are subject to change. As always, we recommend you do your own research as well.

Summary of Money’s Best VA Home Loan Lenders of April 2024

Source: money.com