Apache is functioning normally

Older Americans who own their home are financially incentivized to stay put, which is likely to worsen the ongoing inventory shortage, two Redfin studies found.

In one recent survey, Redfin found that over three-quarters (78%) of older American homeowners (ages 60 and up) are planning to stay in their current home as they age. Meanwhile, about one in five baby boomers (19%) are considering moving into a community with older people or have already done so. Smaller shares of baby boomers are considering moving in with an adult child, moving to an assisted-living facility or moving in with friends.

The inertia of baby boomers is making it harder for young Americans to find a family home, according to a Redfin analysis. In fact, empty-nest baby boomers own 28% of three-bedroom homes in the U.S., while millennials with kids own just 14%. Furthermore, nearly 80% of boomers own the home they live in, compared to 55% of millennials.

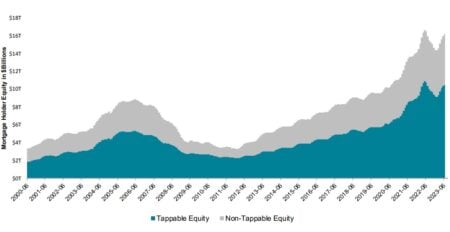

Additionally, 54% of boomers carry no mortgage, and for those who do have a mortgage, nearly all of them have a much lower interest rate than they would if they sold and bought a new home today.

According to the April 2024 Mortgage Monitor report from Intercontinental Exchange (ICE), homeowners who took out mortgages with near-record-low rates in 2020 and 2021 face much higher monthly payments even if they move to an equivalently priced home. A “lateral move” of this type would cost 60% more per month, ICE reported.

There are now 517,000 single family homes on the market, up by 26% from a year ago, according to data from Altos Research. Inventory has been expanding steadily for 20 weeks in a row but still remains at historically low levels. Mike Simonsen, founder and president of Altos Research, forecasts that there will be 700,000 homes on the market by August or September of this year, the most homes available since 2019.

“Older Americans are aging in place because it makes financial sense, but also because it’s human nature to avoid thinking about challenging scenarios such as needing help as you get older,” Redfin chief economist Daryl Fairweather, said in a statement. “In reality, many homeowners and renters will need to move somewhere that better meets their needs as they age, like a senior-living community or a one-story home in an accessible neighborhood.

“But the government isn’t prioritizing building housing for seniors, which is further encouraging older Americans to stay put, exacerbating the inventory shortage. Politicians should focus on expanding housing stock that meets the needs of older Americans, which could help with housing affordability and availability for all.”

In certain states like California or Texas, tax systems make it advantageous for people to stay in their homes as they age. Medical and technological advancements have also made it increasingly easy for people to stay in their home as they get older.

More than half (51%) of baby boomers who don’t plan to move say that they like their home and see no reason to move, according to Redfin’s survey. The real estate brokerage conducted this survey in February 2024, collecting 838 responses from baby boomers (ages 60 to 78) and 62 responses from members of the Silent Generation (ages 79 and older).

Related

Source: housingwire.com