Apache is functioning normally

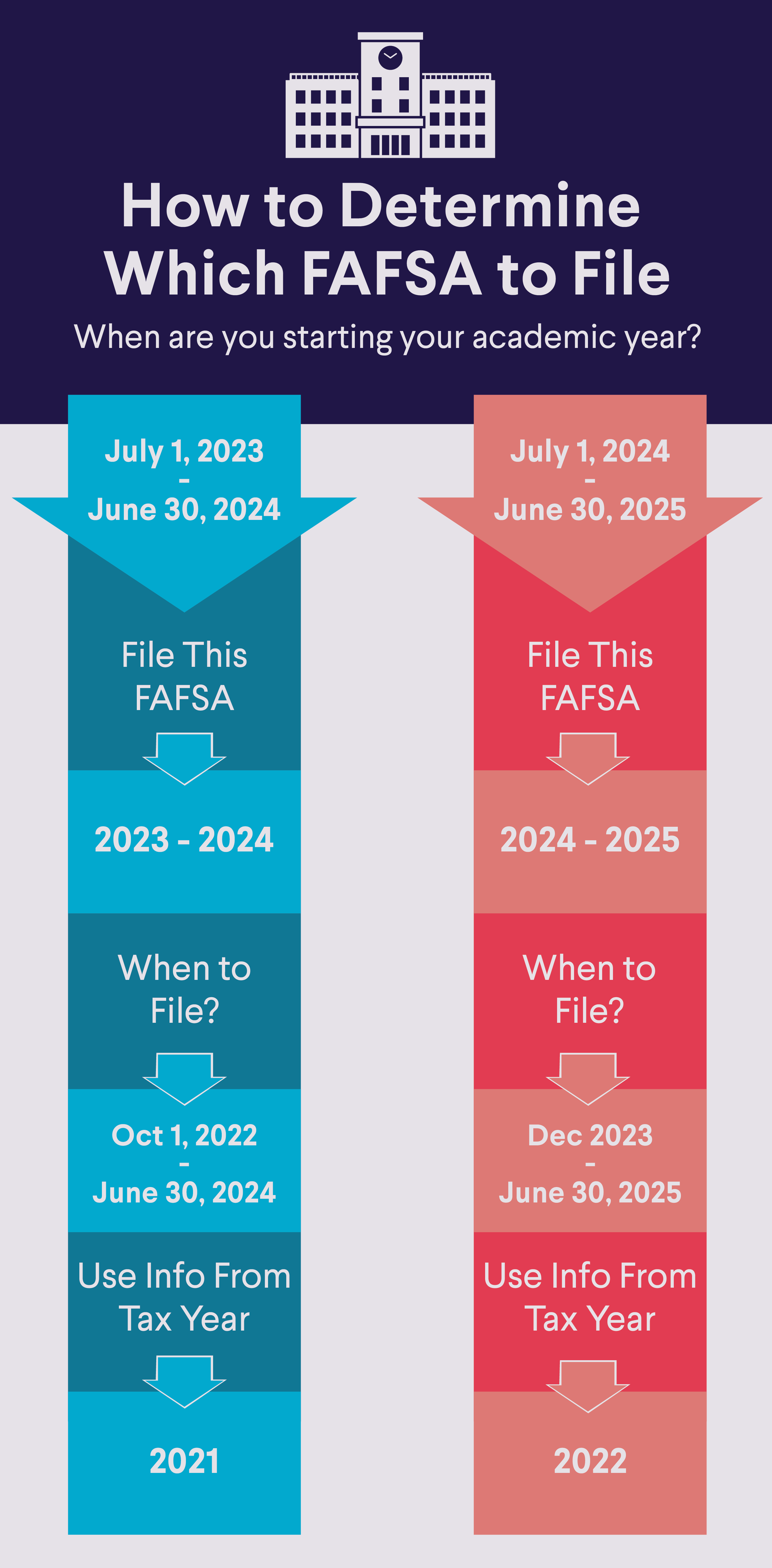

Editor’s Note: Due to major changes coming to the FAFSA, the form for the 2024-2025 academic year is delayed until December 2023. This article reflects the most recent information, but final details will not be available until the new FAFSA form is released.

The Free Application for Federal Student Aid, or FAFSA®, is a form students can fill out each school year to apply for college grants, work-study programs, federal student loans, and certain state-based aid.

By not filling out the form, or missing the FAFSA deadline, students may not receive financial aid that could help them pay for college. Indeed, the graduating class of 2022 left roughly $3.6 billion in need-based federal Pell Grants on the table by not completing the FAFSA, according to a new report by the National College Attainment Network (NCAN).

Typically, the FAFSA becomes available on October 1 for the following academic year. The 2024-2025 academic year, however, is an exception. Due to upcoming changes to the FAFSA (and some adjustments to how student aid will be calculated), the form will be available in December 2023.

It’s helpful to fill out your FAFSA as early as possible and not miss the important application deadlines, as there is a limited amount of aid available.

Read on for key federal, state, and institutional FAFSA deadlines to know.

What Is the FAFSA?

The FAFSA is the online form that you must fill out to apply for financial aid from the federal government, state governments, and most colleges and universities. The form requires students and their parents to submit information about household income and assets. That information is used to calculate financial need and determine how much aid will be made available.

If you are a dependent student, you will need to submit your parents’, as well as you own, financial information. If you are considered independent, you are not required to submit your parents’ financial information.

If you are already in school, remember that the FAFSA must be filled out every year, since income and tax information might have changed.

Federal financial aid includes student loans, grants, scholarships, and work-study jobs. In general, the eligibility requirements for federal aid state that for most programs, students:

• Must demonstrate financial need (though there is some non-need based aid, such as unsubsidized student loans) and,

• Must be a U.S. citizen or an eligible noncitizen, and

• Be enrolled in an qualifying degree or certificate program at their college or career school

For further details, take a look at the basic eligibility requirements on the Student Aid website.

💡 Quick Tip: You can fund your education with a low-rate, no-fee private student loan that covers all school-certified costs.

FAFSA Open Date and Deadline

File Your FAFSA for Next Year Close to December

Generally, it makes sense to submit the FAFSA promptly after the October 1st application release — or, in the case of the 2024-25 FAFSA, December 2023. Some aid is awarded on a first-come, first-served basis, so submitting it early could help improve your chances of receiving financial help for college.

File Your FAFSA for Last Year by June 30

You must file the FAFSA no later than June 30th for the school year you are requesting aid for. So, for the academic year 2023-24, you must file by June 30th, 2024, at the very latest, and for the academic year 2024-25, the final federal deadline is June 30th, 2025.

This FAFSA deadline comes after you’ve already attended and, likely, paid for school. You generally don’t want to wait this long. However, if you do, you can often receive grants and loans retroactively to cover what you’ve already paid for the spring and fall semester. Or, in some cases, you may be able to apply the funds to pay for 2023 summer courses.

State and institutional FAFSA deadlines

When the FAFSA is due is also dependent on where you want to go to college. Individual states and colleges have different deadlines — which may be much earlier than the federal deadline — for awarding financial aid to students. Here’s a look at two other key FAFSA deadlines to know.

Institutional FAFSA Deadlines

While students have until the end of the school year to file the FAFSA, individual schools may have earlier deadlines. These priority deadlines mean you need to get your FAFSA application in by the school’s date to be considered for the college’s own institutional aid. So if you are applying to several colleges, you may want to check each school’s FAFSA deadline and complete the FAFSA by the earliest one.

While filling out your FAFSA, you can include every school you’re considering, even if you haven’t been accepted to college yet.

State FAFSA Deadlines

States often have their own FAFSA deadlines. You can get information about state deadlines at Studentaid.gov. Some states have strict cutoffs, while others are just best-practice suggestions — so you’ll want to check carefully. States may have limited funds to offer as well.

Federal FAFSA Deadline

Typically, the FAFSA becomes available on October 1, almost a full year in advance of the year that aid is awarded. For the 2024-25 academic year, the FAFSA will open a few months later than usual — some time in December 2023. However, the federal government gives you until June 30th of the year you are attending school to apply for aid.

It’s generally recommended that students fill out the FAFSA as soon as possible after it’s released for the next school year’s aid to avoid missing out on available funds. Plus, there are often earlier school and state deadlines you’ll need to meet.

Recommended: FAFSA Delay: 5 Steps to Help Ensure Your State and College Aid Aren’t Affected

Taking the Next Steps After Submitting the FAFSA

So what happens after you hit “submit” on your FAFSA? Here’s a look at next steps:

• Wait for your Student Aid Report (SAR). If you submitted your FAFSA online, the U.S. Department of Education will process it within three to five days. If you submit a paper form, it will take seven to 10 days to process. The SAR summarizes the information you provided on your FAFSA form. You can find your SAR by logging in to fafsa.gov using your FSA ID and selecting the “View SAR” option on the My FAFSA page

• Review your SAR. Check to make sure all of the information is complete and accurate. If you see any missing or inaccurate information, you’ll want to complete or correct your FAFSA form as soon as possible. The SAR will give you some basic information about your eligibility for federal student aid. However, the school(s) you listed on the FAFSA form will use your information to determine your actual eligibility for federal — and possibly non-federal — financial aid.

• Wait for acceptance. Most college decisions come out in the spring, often March or early April. If you applied to a college early action or early decision, you can expect an earlier decision notification, often around December. Typically, you will receive a financial aid award letter along with your acceptance notification. This letter contains important information about the cost of attendance and your financial aid options.

Understanding Your Financial Aid Award

Receiving financial aid can be a great relief when it comes to paying for higher education. Your financial aid award letter will include the annual total cost of attendance and a list of financial aid options. Your financial aid package may be a mix of gift aid (which doesn’t have to be repaid), loans (which you have to repay with interest), and federal work-study (which helps students get part-time jobs to earn money for college).

If, after accounting for gift aid and work-study, you still need money to pay for school, federal student loans might be your next consideration. As an undergraduate student, you may have the following loan options:

• Direct Subsidized Loans Students with financial need can qualify for subsidized loans. With this type of federal loan, the government covers the interest that accrues while you’re in school, for six months after you graduate, and during periods of deferment.

• Direct Unsubsidized Loans Undergraduates can take out direct unsubsidized loans regardless of financial need. With these loans, you’re responsible for all interest that accrues when you are in school, after you graduate, and during periods of deferment.

• Parent PLUS Loans These loans allow parents of undergraduate students to borrow up to the total cost of attendance, minus any financial aid received. They carry higher interest rates and higher loan origination fees than Direct Subsidized and Unsubsidized Loans.

If financial aid, including federal loans, isn’t enough to cover school costs, students can also apply for private student loans, which are available through banks, credit unions, and online lenders.

Private loan limits vary by lender, but students can often get up to the total cost of attendance, which gives you more borrowing power than you have with the federal government. Each lender sets its own interest rate and you can often choose to go with a fixed or variable rate. Unlike federal loans, qualification is not need-based. However, you will need to undergo a credit check and students often need a cosigner.

Keep in mind that private loans may not offer the borrower protections — like income-based repayment plans and deferment or forbearance — that come with federal student loans.

💡 Quick Tip: Parents and sponsors with strong credit and income may find much lower rates on no-fee private parent student loans than federal parent PLUS loans. Federal PLUS loans also come with an origination fee.

The Takeaway

Completing the FAFSA application allows you to apply for federal aid (including scholarships, grants, work-study, and federal student loans). The FAFSA form is generally released on October 1st of the year before the award year and closes on July 30th of the school year you are applying for.

The 2024–25 FAFSA will be delayed until December 2023 due to changes the U.S. Department of Education is implementing to make the application more streamlined for students and families. That application will close on June 30, 2025. However, individual colleges and states have their own deadlines which are typically earlier than the federal FAFSA deadline.

If you’ve exhausted all federal student aid options, no-fee private student loans from SoFi can help you pay for school. The online application process is easy, and you can see rates and terms in just minutes. Repayment plans are flexible, so you can find an option that works for your financial plan and budget.

Cover up to 100% of school-certified costs including tuition, books, supplies, room and board, and transportation with a private student loan from SoFi.

SoFi Loan Products

SoFi loans are originated by SoFi Bank, N.A., NMLS #696891 (Member FDIC). For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

SoFi Private Student Loans

Please borrow responsibly. SoFi Private Student Loans are not a substitute for federal loans, grants, and work-study programs. You should exhaust all your federal student aid options before you consider any private loans, including ours. Read our FAQs.

SoFi Private Student Loans are subject to program terms and restrictions, and applicants must meet SoFi’s eligibility and underwriting requirements. See SoFi.com/eligibility-criteria for more information. To view payment examples, click here. SoFi reserves the right to modify eligibility criteria at any time. This information is subject to change.

Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.

External Websites: The information and analysis provided through hyperlinks to third-party websites, while believed to be accurate, cannot be guaranteed by SoFi. Links are provided for informational purposes and should not be viewed as an endorsement.

SOIS1023015

Source: sofi.com