Apache is functioning normally

No one can predict the future of real estate, but you can prepare. Find out what to prepare for and pick up the tools you’ll need at Virtual Inman Connect on Nov. 1-2, 2023. And don’t miss Inman Connect New York on Jan. 23-25, 2024, where AI, capital and more will be center stage. Bet big on the future and join us at Connect.

It’s been nearly 30 years since so few homeowners were seriously delinquent on their mortgages, but that trend could come under pressure if early-stage delinquencies continue to creep up, according to a sneak peak at August numbers released Friday by data aggregator Black Knight.

Black Knight’s first look at its August data showed 448,000 homeowners were seriously delinquent in August, meaning they hadn’t paid their mortgage in 90 days or more. That’s the lowest level since June 2006, after a 4 percent drop from July and a 25 percent decline from a year ago, when about 600,000 homeowners were seriously delinquent.

The number of homes in active foreclosure was also down 24 percent in August compared to pre-pandemic levels, falling by 5,000 from July to 215,000. That’s the lowest level since March 2022 after foreclosure moratoriums put in place during the pandemic were lifted.

At 3.17 percent, the overall delinquency rate improved from 3.21 percent in July, and is nearly a full percentage point below the average for August from 2015 through 2019.

But Black Knight said the number of homeowners who were in the early stages of delinquency (30 or 60 days behind on their payments) has increased for three months in a row, suggesting that delinquency rates may be nearing a bottom.

“We don’t necessarily think that serious delinquencies are going to begin to rise – that population is still improving at a relatively healthy clip,” a Black Knight spokesperson told Inman via email.

Foreclosure starts were also up by 21 percent from July to August, but at 31,900 were still 21 percent below pre-pandemic levels.

The five states with the highest percentage of seriously delinquent borrowers were all in the Southeast: Mississippi (2.12 percent), Louisiana (1.76 percent), Alabama (1.43 percent), Arkansas (1.20 percent) and Georgia (1.15 percent).

Black Knight — which is now part of Intercontinental Exchange Inc. following an $11.9 billion acquisition that closed Sept. 5 — will release its more in-depth Mortgage Monitor report on Oct. 2.

Monthly payments at record high

The last Black Knight Mortgage Monitor report found that due to rising mortgage rates and home prices, buyers purchasing a home in July were facing average principal and interest payments of $2,306 a month, the highest on record and a 60 percent increase from a year ago.

Equity insulates many from foreclosure

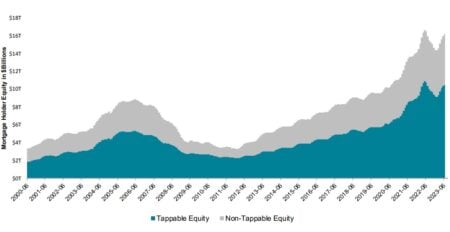

Source: Black Knight Mortgage Monitor, August 2023.

But rising home prices have also given many homeowners a comfortable equity cushion that could allow them to avoid foreclosure if they have trouble making their monthly payments, as they’d be able to sell their homes and walk away with some cash.

When the Black Knight Mortgage Monitor last tackled that subject in depth, the report found mortgage borrowers had more than $16 trillion in equity in June, or an average of $199,000 per household.

At $10.5 trillion, tappable equity – the amount that can be safely cashed when refinancing, while still leaving a 20 percent equity cushion – was within $434 billion of record 2022 peaks.

Editor’s note: This story has been updated to clarify that Black Knight expects that the overall delinquency rate may rise, not serious delinquencies. Historically, sustained increases in short-term delinquency rates can push up the serious delinquency rate.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter

Source: inman.com