Apache is functioning normally

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

Nearly 215 million U.S. drivers carry car insurance, and many may ask themselves, “Why is my car insurance so high?” If you’re one of those Americans, know that there are ways you can take control of the situation and reduce your insurance premiums.

We’ll guide you through why your car insurance may be higher than normal and ways you can proactively work to lower the costs.

1. Credit Score

Most insurance providers consider your credit score when determining insurance rates. Maintaining a good credit score can help individuals maintain a lower insurance premium. However, those with poor credit scores often need to pay more since they are seen as being higher risk.

Factors that impact your FICO® credit score include:

- Length of credit history

- Payment history

- Credit mix

- Amount owed

- New credit

Keep in mind that credit score is only one factor used by insurers to set premiums.

2. Driving Record

Your driving record can significantly impact your insurance premium costs. Those with clean driving records without any traffic violations or accidents tend to pay lower insurance premiums. However, policyholders who have been in vehicle accidents and accrued traffic violations may pay for higher insurance premiums. Your insurance provider can increase your premium for:

- Speeding tickets

- DUIs and DWIs

- Parking tickets

Your insurance may provide safe driver discounts to those with good driving records and who are accident-free for a required period. These discounts can decrease your insurance premiums.

3. Coverage Levels and Types

Your insurance rates can be significantly affected by the coverage type and insurance level you opt for. Depending on where you reside, your state has regulations and criteria for minimum policy coverage.

For example, Washington requires drivers to have the following minimum coverage:

- $25,000 per person for bodily injury or death in an accident

- $50,000 per person for bodily injury or death of any two people in an accident

- $10,000 of injury to or destruction of property of others in an accident

Depending on other factors, like your vehicle type and whether it’s leased, you may require additional coverage on top of the minimum state requirements.

4. Claim History

Similar to your driving record, you want to keep your claim history as unscathed as possible. However, accidents happen, whether they result from your actions or those of another driver. Multiple filed claims can impact premium costs, especially if they are large claims, like a totaled vehicle. Plus, claims have a long-lasting impact—an at-fault accident can increase your rates for at least three years following the claim.

5. Location

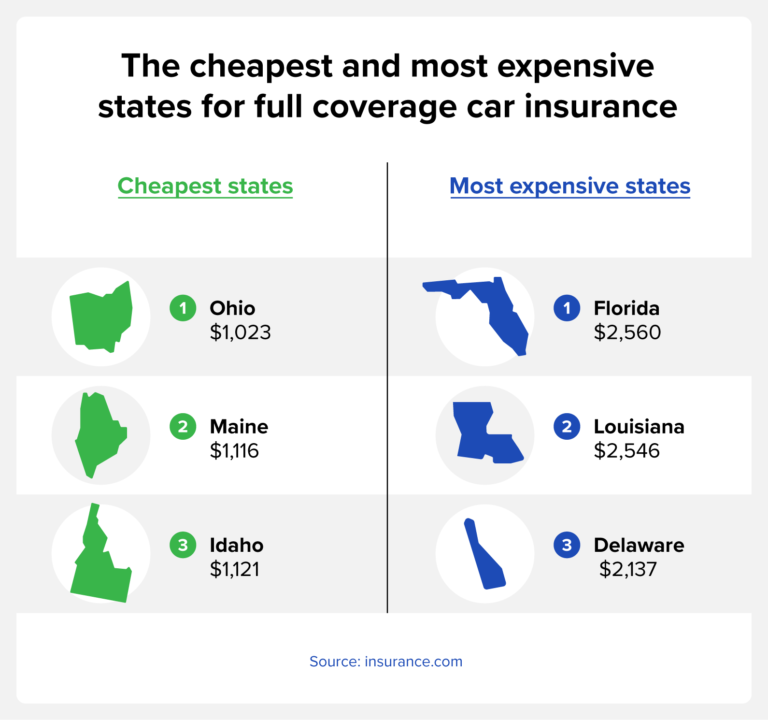

Insurance premiums can greatly vary by location, especially if you live in a city versus a more rural area. Insurance premiums in each state are affected by various factors, including:

- Rate of uninsured motorists

- Frequency of filed claims

- Minimum insurance limits

Things like road conditions and crime rates can also impact your auto insurance. For example, If you live in an area with high auto theft rates and poorly planned roads that are prone to cause accidents, you’ll likely be paying higher insurance rates.

6. Type of Vehicle

When insurers determine insurance premiums, they consider vehicle types. Certain car models have a lower likelihood of ensuring the safety of passengers or cost more to repair in the case of an accident, leading to higher insurance rates.

Vehicles that typically have higher rates are:

- Smaller cars: Compact vehicles sustain more extensive damage in a crash, so they’ll usually have higher coverage rates.

- Leased cars: Leasing companies typically require full coverage for leased vehicles, including comprehensive and collision coverage, to cover damage in a potential accident.

- Cars with premium features: Trim levels and technological features, such as touch screens, can be expensive to repair when damaged. Providers keep this in mind when providing a premium. However, a vehicle with advanced safety features is at lower risk, resulting in a lower premium.

Vehicles that typically have lower rates are:

- Small SUVs and minivans: Safer and bigger cars tend to have the most reasonable insurance rates.

- Older cars: Most car values depreciate over time. In the case of an accident, your provider will need to pay out less than a newer vehicle. The exception is collector and classic vehicles.

Overall, newer, luxurious, smaller vehicles tend to have more expensive premiums.

7. Gender or Age

Gender can impact your insurance premiums in the majority of states. However, there are states that have banned gender in insurance rating, including:

- California

- Michigan

- Massachusetts

- Pennsylvania

- North Carolina

- Montana

- Hawaii

Your age is another uncontrollable factor that impacts your insurance rates. Your insurer will likely charge you more if you have young drivers under 25 on your insurance policy. This is because they’re viewed as less experienced drivers with a higher risk of filing a claim.

8. Insurance Company

Rates vary across insurance providers. It’s easy to stick to renewing the same policy every year, but you could be losing out on savings by switching insurance companies. Among the leading auto insurance companies across the country, the average annual car insurance rate stands at $1,547 per year. Yet, a driver with identical coverage may pay as little as $1,022 with one company or as much as $2,135.

9. Driving Patterns

When you apply for insurance, expect your insurance provider to inquire about your occupation and residence. How often you drive and how much time you spend behind the wheel can increase your insurance premiums.

Those with longer work commutes increase their risk of being in an accident while they’re on the road. If you work in an expensive city and live in the suburbs outside the city to save on housing costs, you could, unfortunately, be paying a higher insurance rate.

10. Deductibles

Your deductible is the amount you would need to pay if your car is damaged and you file a claim. Your insurance provider pays the remaining total cost to fix your vehicle. For example, if you have a $500 deductible and file a claim for $2,500 in damages, you’ll need to pay the $500 and your insurance will cover the final $2,000.

If you pay for a lower deductible on your policy, there’s more risk for your insurance provider. Therefore, you’ll likely have to pay for higher insurance premiums.

11. Policy Add-ons

Take a look at your policy add-ons. You may be paying for additional coverage you don’t currently need. Evaluate whether it’s necessary to cover items like:

- Car rental coverage

- Roadside assistance

- Comprehensive and collision coverage

While some of these additional coverage items can be beneficial, they aren’t essential expenses.

12. Car Insurance History

Your car insurance history can impact your insurance premium costs. If you have lapses in your insurance history, periods where you didn’t hold insurance, you can be penalized with higher premiums. Reasons for having gaps in your insurance history include:

- Being dropped from your insurance provider

- Your insurance expires and you can’t review your policy

- You don’t have a vehicle and therefore don’t require auto insurance

You should always have auto insurance when you own a vehicle. Consider acquiring nonowner car insurance if you don’t own a vehicle—it provides coverage when driving cars you don’t own and prevents future premium increases when you do own one.

5 Ways to Lower Your Car Insurance Premium

As noted above, various factors can skyrocket your car insurance costs. Luckily, there are steps you can take to help lower your premiums and keep more money in your pocket.

1. Maintain a Good Credit Score

Your credit score can greatly impact how expensive your premium is. Improving your credit can help you find lower premiums in the future. Actions that can potentially improve a credit score is:

- Reviewing your credit report for inaccuracies and errors and correcting them

- Paying off any outstanding revolving debt

- Opening a secured credit card if you don’t qualify for a traditional card

- Completing payments on time

Improving your credit takes time, especially if you have multiple derogatory marks on your report. Be patient and smart while building your credit back up.

2. Get Rid of Unnecessary Coverage

Review your current coverage and evaluate whether you’re paying for add-on coverage you don’t need. For example, if you aren’t frequently renting cars, you likely don’t need car rental coverage. If you do rent a car for occasions like a business trip or vacation, your insurance should cover any damage caused to the rented vehicle.

3. Bundle Your Policies

For homeowners, bundling your home and auto policies can help lower your premiums. We recommend comparing bundling quotes from both of the providers before deciding which provider policy to cancel. Not only can you potentially save on both your premiums, but you will also be able to manage these expenses with one provider.

4. Raise Your Deductible

Opting for a higher deductible on your car insurance can help lower your premium rate. Your deductible is what you would pay “out of pocket” in a claim. However, you should be able to pay your deductible in case of an accident. If you increase your deductible too much, your insurance won’t cover smaller damages and repairs.

5. Compare Multiple Quotes

Has it been a while since your insurance premium was set? Shopping around at different insurance providers is the easiest way to get a lower insurance premium. If it’s time to renew your policy and you have a clean driving record, it may be a good time to compare quotes and see if other providers can provide a lower premium.

FAQ

Below are frequently asked questions about car insurance expenses and factors.

Does My Credit Score Affect My Car Insurance Rates?

Your credit score is factored in when your provider calculates your insurance premiums. Those with poorer credit scores (below 580 on the FICO scale and below 601 on the VantageScore® scale) tend to pay higher rates than those with good credit scores. Improving your credit score will help you secure favorable insurance rates and in other financial situations, like when you’re applying for a loan.

How Can I Lower My Auto Insurance Premiums?

There are a few actions you can take to potentially lower your insurance premiums, including:

- Purchase a smaller, older vehicle

- Remove unnecessary policy add-ons

- Improve your credit

- Raise your deductible

- Bundle your home and auto policies

- Shop around for rates

Why Does It Cost More to Insure an Expensive Vehicle?

There are several reasons why auto insurance costs are higher for an expensive vehicle. Luxury cars have more expensive parts, such as high-tech and advanced safety features. Also, if your vehicle is severely damaged and declared totaled, your insurance provider will need to cover the value of your car.

View New Car Loan Rates With Credit.com

Now that you know why your car insurance is so high, it’s time to take steps to reduce your premiums. Credit.com can provide you with a free credit score and credit report so you can see where you need to start working on your credit and lowering your premium rates.

If you’re shopping for a new auto loan, Credit.com offers custom that won’t impact your credit. Get prequalified and see your rates today.

Source: credit.com