No one can predict the future of real estate, but you can prepare. Find out what to prepare for and pick up the tools you’ll need at the immersive Virtual Inman Connect on Nov. 1-2, 2023. And don’t miss Inman Connect New York on Jan. 23-25, 2024, where AI, capital and more will be center stage. Bet big on the roaring future, and join us at Connect.

The U.S. looks to be headed for a “mild recession” in the first half of next year, but continued strength in the economy could keep mortgage rates from coming down as much as previously expected, economists at mortgage giant Fannie Mae said in a forecast released Monday.

While the Federal Reserve isn’t expected to raise rates when policymakers wrap up a two-day meeting Wednesday, persistent inflation could still prompt the Fed to hike rates later this year, or implement a “higher for longer” rate strategy.

The good news is that even though mortgage rates have settled in above 7 percent, the risk that rates will do even more damage to home sales is limited, as the share of cash purchases remains high and sales are now driven more by life events than discretionary move-up buys, Fannie Mae forecasters said.

Nevertheless, Fannie Mae economists forecast that home sales will drop by 14.7 percent this year, and stay at about the same level next year.

“We expect that total housing market activity will remain at a low level into 2024 as the Federal Reserve continues to hold the line on interest rates against inflation,” Fannie Mae Chief Economist Doug Duncan said, in a statement.

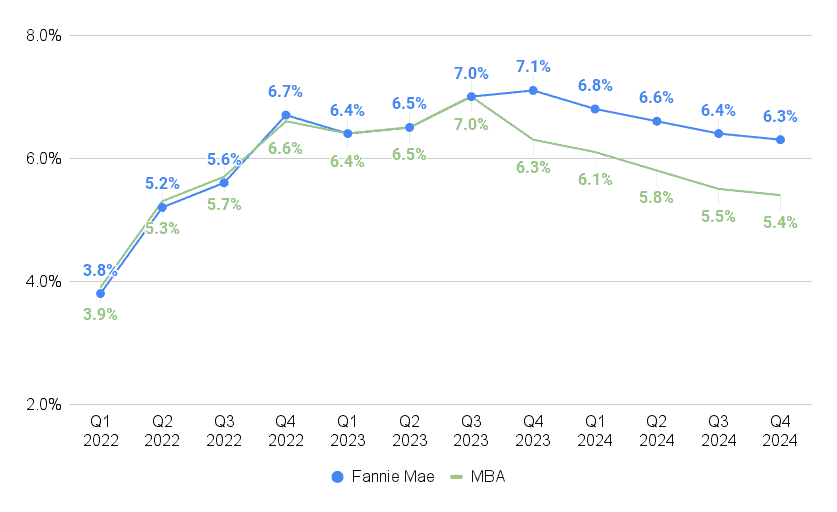

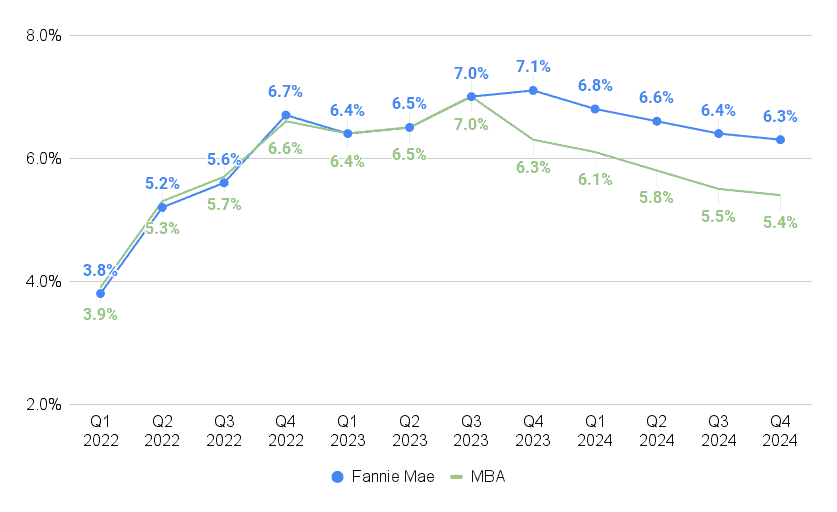

Last month, economists at Fannie Mae were expecting rates for 30-year fixed-rate conforming mortgages would peak at 6.8 percent during the third quarter of this year before retreating to an average of 6 percent during the final three months of 2024. Forecasters at the Mortgage Bankers Association (MBA) were even more optimistic, predicting mortgage rates would drop to an average of 5 percent by Q4 2024.

Mortgage rates projected to ease next year

Source: Fannie Mae, Mortgage Bankers Association forecasts.

That was before strong economic data sent rates on the popular 30-year fixed-rate conforming loans soaring to a 2023 high of 7.30 percent, according to rate lock data tracked by the Optimal Blue Mortgage Market Indices, which show rates have only pulled back slightly since then.

With the economy cooling more slowly than expected, Fannie Mae analysts now see mortgage rates peaking at 7.1 percent during the final three months of 2023, before easing to 6.3 percent by Q4 2024. In releasing their latest forecast Monday, MBA economists predicted mortgage rates will start coming down this year, but remain well above 5 percent next year.

Home sales projected to drop 17.4% this year

Source: Fannie Mae Housing Forecast, September 2023.

Fannie Mae is forecasting 4.8 million total home sales in 2023, which would be a 17.4 percent drop from last year and the slowest annual pace since 2011. Next year isn’t expected to be much different, with sales expected to bounce back by less than 1 percent.

“While the additional downside risk from rate movements to date is minimal, the prospects of a recovery in existing sales in the near future is unlikely given strong mortgage rate ‘lock-in’ effects and stressed affordability,” Fannie Mae economists said in commentary accompanying their September forecast.

New home sales are expected to grow by more than 6 percent this year, as builders race to complete homes in markets where the lock-in effect — reluctance on the part of homeowners to give up the low rate on their existing mortgage — has made listings scarce.

“New home sales were surprisingly strong in the first half of the year, due partly to homebuilder rate buydowns, which become more expensive when mortgage rates rise,” Duncan noted. But he said Fannie Mae forecasters expect new home sales to pull back slightly next year, “due to the higher mortgage rate environment and recent decline in homebuilder confidence.”

The National Association of Home Builders/Wells Fargo Housing Market Index, a gauge of builder confidence, dipped six points in August and another five points in September, to 45. It was the first time the index has been below 50 in five months, which indicates more builders view conditions as poor than good.

The recent rebound in mortgage rates “is making homebuilders nervous,” Pantheon Macroeconomics Chief Economist Ian Shepherdson said in a note to clients Monday.

“To be clear, the impact of mortgage rates returning to 7-1/4 percent from their recent 6-1/2 percent lows will be nothing like as bad as the initial surge from 3 percent to 7-1/4 percent in the year to September 2022,” Shepherdson said. “But it ought to be enough to quash the nonsensical media/Fed narrative that the housing market is starting to recover. It isn’t.”

Large pipeline of multifamily housing coming online

Source: Fannie Mae Housing Forecast, September 2023.

Fannie Mae economists expect single-family housing starts to plateau at 910,000 next year, and for multifamily construction to slow by 22 percent, to 389,000 units.

“With sluggish rent growth on a national level, more normalized vacancy rates, and tighter construction and development loan lending standards, we expect multifamily construction starts to continue to slow,” Fannie Mae forecasters said. “These dynamics may also play into softening demand for single-family housing: There is a large pipeline of multifamily housing coming online, and the rent-to-buy calculus for prospective homebuyers may tilt a little more in favor of renting for longer.”

Mortgage lending expected to grow by 20% next year

Source: Fannie Mae Housing Forecast, September 2023.

With home prices holding firm and mortgage rates expected to ease next year, Fannie Mae forecasters expect mortgage originations will grow by 20 percent next year. The slight uptick in home sales projected for next year would boost purchase loan originations by 9.4 percent, to $1.433 trillion, while lower mortgage rates are expected to boost refinancing by 76 percent, to $442 billion.

Mild recession seen as ‘likeliest outcome’ of Fed tightening

Fannie Mae economists have been predicting that the U.S. was headed for a recession since April 2022, after the Fed began raising interest rates and the impact of stimulus measures introduced during the pandemic faded.

While mixed economic data continues to “muddle the near-term outlook,” Fannie Mae economists say they continue to expect a “mild recession” in the first half of 2024, based on the belief that consumers will need to rein in spending in order to live within their means.

“Fundamentally, personal consumption remains at what we believe to be an unsustainable level relative to incomes, and the full effects of monetary policy tightening are still working through the economy,” Fannie Mae forecasters said.

In their weekly brief on the U.S. economy, Shepherdson and his Pantheon Macroeconomics colleague Kieran Clancy noted three potential wildcards on the economic horizon: A strike launched last week by the United Auto Workers targeting the big three automakers, next month’s resumption of federal student loan payments, and a “likely” government shutdown.

“An all-out strike lasting a month could be expected to depress quarterly GDP [gross domestic product] growth by about 1.7 percentage points, before taking account of the hit to the supply chain,” the Pantheon Macroeconomics team said. “The problem for the Fed is that it would be impossible to know in real time how much of any slowing in economic growth could confidently be pinned the strike, and how much could be due to other factors, notably the hit to consumption from the restart of student loan payments. The latter already is making itself felt in falling restaurant diner and airline passenger numbers.”

Fannie Mae economists agree that a sustained strike could “drive a negative payroll report in October, as well as dampen the GDP measure,” but that a short-lived strike “would likely be followed by a rebound in auto manufacturing output thereafter.”

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter

Source: inman.com