Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Last April, when Bed Bath & Beyond held its store-closing sales after declaring bankruptcy, I popped into one of its Manhattan locations and found the shelves almost completely stripped of inventory, snagged by earlier shoppers who’d been quicker to the liquidation bargains. Dwell’s senior home guides editor Megan’s experience at another Manhattan location, though, seemed slightly less chaotic, and even in small but not insignificant ways gratifying. So last week, when Dwell’s managing editor Jack Balderrama Morley dropped a tweet in a team Slack channel pointing out the “crazy sales” at another major retailer, Joann, which on March 18 announced it filed for bankruptcy, and said: “Maybe a writer wants to go and see what home design can be pulled out of a dying store?” I bravely volunteered. Most of the online reactions I’d seen to Joann’s bankruptcy were more focused on corporate details than implications for crafters, but I assumed the news would circulate widely enough in at least some corners of TikTok’s DIY universe that the sales would generate a fairly quick clean out.

To be clear, my putting myself forward is only notable because from where I live in Manhattan, a trip to the craft store—or any department store, really—is a vastly different experience than in the suburbs. The Hudson, Ohio-based chain, which has operated for more than 80 years, has roughly 800 stores nationwide (all of which the company said will continue to operate as it restructures its finances). But none of those stores are in Manhattan, or even Brooklyn. Long Island has three locations, and there’s one in Scarsdale, about an hour’s drive north of my apartment (closer to Connecticut in actuality). Across the Hudson, there’s a Joann store in Paramus, New Jersey. Depending on the time of day, the drive is anywhere between 30 and 50 minutes.

My girlfriend and I have a Zipcar membership that we use almost solely for the purpose of completing another task that’s a vastly different experience when you live in New York City: grocery shopping. Every other month or so, we go to a Trader Joe’s outside of the city to stock up on groceries that we can drive home, not carry. We were due for another Big Shop and had also been talking about crafting over the weekend, since the forecast was gross and rainy. In Paramus, there’s a Trader Joe’s all but three minutes from Joann. So Paramus it was. We were making a Saturday of it.

Ohio-based crafts retailer Joann announced it filed for bankruptcy on March 18, but the company said its roughly 800 nationwide stores will continue to operate as it restructures its finances—and right now, the sales are aplenty.

The arts-and-crafts store, formerly known as Jo-Ann Fabrics, was a big part of my childhood. (Full disclosure: I was blissfully unaware of the 2018 rebrand and had been using the former moniker up until I learned about the recent bankruptcy filing, and am still having a tough time adjusting to the name change, in true millennial fashion.) In the early 2000s, the Jo(-)ann (Fabrics)(!) on the side of Highway 101 in Corte Madera, California, was where I bought fabric for weekly sewing classes with Winky Cherry (I’m serious), a kids’ sewing teacher and author, I’m just learning, who taught out of a downstairs room in her home. It’s where I found felt and appliqués for the DIY poodle skirts I wore to school sock hops. It’s also where I found the fabric, pom-poms, and ribbons I tasked my adult neighbor, whose children I babysat, with fashioning into a jester costume for me one Halloween; one side had blue fabric with a moon pattern, the other a maroon background with suns. There were elastic cinches at the wrists and ankles that created frilly cuffs. In retrospect, it was quite a vision for my young mind to conceive of, but stylistically…misguided.

Before last weekend, I hadn’t been back to one of the stores since that time in my childhood. One of Joann’s competitors, Michael’s, has locations in Brooklyn and Manhattan, and I sadly did not retain any sewing skills from Winky Cherry’s classes, so these days the selection there or at Blick Art Materials—of which there are many in New York City—does the trick for my occasional craft projects. I was expecting the scene to be somewhat depressing: sparse aisles stocked with the same art supplies you can now order to your front door on Amazon, piles of worse for wear fabric collecting dust, and nary a shopper born after the turn of the millennium (and that’s being generous). The latter, from my observation, was true, but other parts surprised me.

The clearance sale shelves at the front of the store, marked 25 percent off, were haphazardly stocked as though either winds of eager customers had already blown through them, spoiling any prior display order, or the employees had simply gathered items from other aisles—a partially unwound yarn bundle, decorative stickers, children’s trinkets, and, unexplainably, a pack of popcorn seasoning, and quickly dumped them in this section, knowing any real organization efforts wouldn’t be worth their while.

In addition to the 25 percent markdowns on the storewide clearance sale shelves, deals in other Joann sections included 50 to 70 percent off fine art canvases. We bought a pack of 8×10 canvases for $7.99 and two 5×5 canvases for $3.49 each.

We set ourselves a $200 budget, keeping in mind a few DIY projects we discussed prior, and knowing that we like to keep a stock of craft supplies for impromptu projects, so this sale would be as good a time as ever to spend somewhat freely. First, we popped over to the bead aisles to scope out the four for $10 deals. We picked 15 bead strands—with between 10 to 40 beads per set, depending—and a roll of clear cord (for later necklace-making projects). We also grabbed a small organizer to keep the beads in; not on sale, but something we felt necessary, and reasonable for $4.50. The next aisles had some of the biggest steals we encountered: 10 for $5 on two-ounce acrylic paints, 50 to 70 percent off fine art canvases, and 25 percent off other art supplies, from paint brushes to sets of paint, pens, and colored pencils. We added a 10-pack of 8×10 canvases and two 5×5 canvases to our shopping cart, along with a 24-tube acrylic paint set and a few larger paint tubes, plus a can of black spray paint and some wooden semicircle cutouts for a DIY mirror project.

We walked toward the next part of the store we knew had something we wanted: fiber filling to revive our couch cushions, which we assumed we’d find near the fabric department. Between there and the robust yarn section, it felt, for a second, like we could be in any big box retailer of the home goods ilk. You could buy outdoor rugs, plant stands, picture frames, and storage containers just like what’s in stock at Target or Home Depot. In my memory, the Jo(-)ann (Fabrics)(!) of my youth was much less home decor-oriented.

Still, the crafts and sewing storage items were marked 50 percent off, so we grabbed three collapsible bins in the style of Hay’s recycled color crates for the space above our kitchen cabinets at $5.99 each. I also picked out an 11×14 black picture frame, with visions of repainting it with a two-tone trim using our new acrylics set. We grabbed two large bags of the fiber filling—40 percent off, $17.99 each—and at some point along the way picked up a five-pound bucket of air-dry clay, which ran us $6.99.

Every five or so aisles we’d pass another shopper, which, compared to the experience of shopping at most major retailers, is essentially like walking through a desert, but I’d imagined something much more vacant. I realized I was likely conflating my understanding of bankruptcy with the idea of returning to a forsaken mainstay from my childhood, so to see other customers at all made me feel like the place was sufficiently busy.

The general energy in the store, however, reminded me otherwise. At one point, I heard an exasperated yell from the next aisle, “Is it so hard for people to put things back where they fucking belong?!” I obviously had to check whose Public Display of Begrudge this was; when I walked past, there was only one woman, wearing a Joann apron and organizing inventory.

In the fabric section, we had to squeeze our cart past a plastic storage bin with wet floor signs on either side that was blocking most of the walkway in order to catch droplets from a ceiling leak. I saw another millennial-looking couple talking to a woman at the service counter and wondered what they were there for, feeling an instant sense of curiosity and camaraderie with the other shoppers visibly under 60. We thought about buying some fabric to fashion a small curtain/cabinet skirt to hide our eyesore kitchen trash area, but decided against it—mostly due to decision paralysis, but also because we weren’t sure anything from the fabric selection would even really improve the situation. (As a kid, the actual quality of Jo-Ann’s Fabrics was not something I noticed, apparently.)

At checkout, the sweet (older) cashier winced as our balance climbed and offered to add an extra coupon that was typically only available online to bring our total down. It seemed like she hadn’t rung up a $184.17 tab for anyone in a long time.

(From left): A picture frame we bought half-off for $10 and upcycled with acrylic paints from a 24-tube set on sale for $10.50, and a vase we decorated with beads from the four for $10 deal.

Our first DIY project was the easiest: we added the stuffing to our couch cushions, which have formed light indents in various spots because of my bad habit of WFH…from the couch. Then, we took some of the beads and Gorilla Glued them to a glass vase we already own. I painted the black picture frame with two blue acrylics and put a Really Bad Portrait of us from the Upper West Side flea market in it. (I’m still battling my partner to let us hang it up in the bedroom.)

Next, we spray-painted the wooden semicircles black and Gorilla Glued them to the side of our Ikea Hovet mirror, inspired by furniture we saw at Originario on a recent trip to Mexico City. (We still have enough left to do the same with another black mirror in our dining room.) We used some of the quick-dry clay to make a small, foot-shaped catchall—again, inspired by ceramics we saw in Mexico City. We’re still deciding on what to paint on the canvases, but now we have the supplies at the ready for when inspiration strikes. In fact, we’ve barely scratched the surface of what we bought on our haul, so that trip will last us many more DIY projects. And, should the clearance sales continue and we decide we want more bead deals or actually do want to give that cabinet skirt a try, our receipt has a promo code that can be used on Joann’s website, so we won’t have to brave another visit.

Related Reading:

Retrain Your Brain and Repurpose Your Furniture

I’ll Never Make Another Decor Decision Without a Mood Board

Source: dwell.com

Maximalism home décor is the “in” home design trend for 2024 and includes bold colors and unique pieces. By using maximalism for staging, sellers can highlight a home’s features and personality.

CHICAGO – Allie LeFevere describes her maximalist Chicago home as colorful and eclectic. When she and her husband moved into their home four years ago, she didn’t have a specific design in mind.

“I just wanted the house to feel vibrant,” says LeFevere, founder of branding agency Obedient. She wanted “a representation of our lives and the places we’ve explored and the memories we’ve made.”

The philosophy behind maximalism decor is “more is more,” according to Jean Whitehead, a senior lecturer on interior design at Falmouth University in county Cornwall, England. Bold colors, textures and unique pieces define this style, elements of which Vogue magazine says are “in” as design trends for 2024.

Going maximalist in your home can seem daunting and expensive — but it doesn’t have to be, say those who favor a bold aesthetic. Here’s how to achieve a maximalist look on a budget.

“One of the more economical ways to explore maximalism is through vintage and antique things that are available at thrift stores and estate sales,” says Daniel Mathis, who runs the Instagram account Not A Minimalist with over 70,000 followers.

Mathis’s home in Oklahoma City showcases his maximalist style, including many pieces purchased second-hand. To get a good bargain, Mathis suggests waiting until the last day of an estate sale when prices are typically reduced.

Alex Ammar, a certified financial planner and owner of Paradox Financial based outside Orlando, Florida, recommends setting a budget and decorating in stages.

“You might have different budgets for different tiers of interior decorating,” Ammar says. Second-hand and discount stores are great for decor and accent pieces, while you may spend more on distinct furniture, like a sofa.

Maximalism can mean applying your own creativity to a space. Be bold with reinventing old furniture or items you have around the house. When Mathis fell in love with the Southwest design of a rug, he used the fabric to upholster an armchair in his sitting room.

For a simpler project, you can individually frame travel photos or children’s artwork and hang them together to create a gallery wall above a couch or along a hallway.

Finding ways to reimagine pieces already in your home adds a layer of individuality to the decor while saving you money. Look through your home for items that could use a boost, and browse art and home supply stores for ideas and tools you may need to revive them.

Including noteworthy pieces in your decor is a way to create a one-of-a-kind space —- and it doesn’t have to be pricey. Keep an eye out for items that stand out to you, and be flexible, which can mean building up a collection over time or making minor alterations to a piece.

Mathis started collecting rare Ozark Roadside Tourist pottery about seven years ago. He currently has 150 pieces of the multi-colored, marbleized pottery.

“That’s maximalism for me,” says Mathis. “It’s about lots of color, lots of patterns … but I tried to do it in a very intentional and curated way.”

He purchased his first vase for $50; now, similar Ozark Roadside Tourist vases can sell for nearly $1,000.

LeFevere says her favorite piece in her home is an antique pie cabinet with mesh screens that she painted pastel green to match her kitchen.

“I’m not cooking any pie in my life,” LeFevere says, but the piece is “just really cool.”

LeFevere and Mathis both highlight the importance of knowing what you like while staying open to designs that surprise you. LeFevere visits sites like Pinterest to find styles or decor she likes and saves the images to a Google doc.

Similarly, Mathis built his personal style by clipping photos from decor magazines. He says the fun in maximalist design is the process of discovery.

By knowing what you like, you’ll be able to assemble pieces to fill your space, whether you find them in a thrift store, create them yourself or invest in a special piece.

Ammar says it’s also important to know yourself when it comes to money and how you manage expenses that arise from redecorating, especially if you’re financing purchases.

“If you’re the kind of person who can handle carrying debt, then it can be a really beneficial way to accelerate your timeline,” he says.

Maximalism is about having a home that reflects you and your life rather than any prescribed blueprint. Fill your space with color and mementos to create an aesthetic that brings you joy every time you walk in.

Copyright 2024 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed without permission.

Source: floridarealtors.org

A judgment is an order issued by a judge or jury to settle a lawsuit. This decision details the rights, responsibilities, and obligations of each party. For example, if you fail to pay a debt, the lender can take you to court. In this case, the judge may order you to pay the other party as part of the court’s final judgment.

The order can be issued in one of two forms:

There are several classifications for judgments, including:

Ultimately, if you don’t pay a debt, the lender or bill collector can file a lawsuit against you to recoup the money. The judge or jury determines if and how much money you owe. These terms are laid out in the final judgment.

Your property includes both physical items and money. That means judgment creditors can seek debt payment from more than your wages and bank accounts. They may also take back a car you financed or other personal property. Another option is placing a lien on some of your property, such as your home.

Creditors must follow the law when applying a judgment to take, or seize, your property. Some things are exempt—which means they can’t touch those items or properties. Some examples include the home you live in, the furnishings inside it, and your clothes. State laws identify these items and set limits based on their value.

Non-exempt property can be taken to help meet a judgment debt. Your creditor can take or leverage these possessions in the following ways:

Judgments come in many forms. Below is a look at the five types of judgments.

There are several ways a civil judgment can be determined.

As the name suggests, a judgment after trial is a decision that occurs only after a trial. Once the judge or jury hears all the evidence and makes a final decision, the judge issues a formal judgment in the case.

A consent judgment occurs when both parties negotiate a final settlement. The judge must approve this final agreement, which is done by issuing a formal consent judgment.

A default judgment occurs when the defendant fails to respond to a summons and complaint. In this case, the judge issues a default judgment in favor of the plaintiff without hearing any evidence from the defendant.

Judgments can’t directly impact your credit because the details of these orders aren’t part of your credit report. However, it’s likely that issues leading up to the final judgment could affect your credit. For example, your payment history can remain on your credit report for up to seven years. If you have any missing or late payments that led to the judgment, this history can impact your credit score.

A judgment could also have a positive effect on your credit. For example, once the debt is paid, the account balance should change to zero on your credit report. This could help lower the amount of debt you owe, which could impact your credit utilization rate.

Once the judge issues a judgment, you can use Credit.com’s Free Credit Score service to see if it had any effect on your score. As you work to rebuild your credit, you can enroll in Credit.com’s ExtraCredit® program to monitor your credit score over time.

Judgments aren’t reported on your credit report and don’t directly impact your credit score. However, judgments are public records, so lenders could still have access to this information. This could affect your ability to secure credit in the future.

Once the judge enters a judgment, both parties must abide by the order. For example, you must pay the amount of money ordered by the judge, and the creditor must mark the account paid in full once payment is made. If you can’t pay the amount all at once, you may be able to set up a payment arrangement. You’re legally obligated to make these payments.

The court enters a judgment against you if your creditor wins their claim or you fail to show up to court. You should receive a notice of the judgment entry in the mail. The judgment creditor can then use that court judgment to try to collect money from you. Common methods include wage garnishment, property attachments, and property liens.

State laws determine how much money and what types of property a judgment creditor can collect from you. These laws vary. So, you need to look to your own state for the rules that apply. A consumer law attorney can help you understand your state’s laws on judgment collections.

There’s a major difference between civil court and criminal court.

A civil court typically involves disputes between two parties. For instance, it could involve a case between two individuals, two organizations, or one organization and one individual. These cases often pertain to a breach of contract, an unsettled debt or a lack of services.

Unless both parties agree to the facts of the case, the judge gives each party the opportunity to present evidence. For example, if a debt collector takes you to civil court for an unpaid bill, you can provide evidence of any payments you made. After hearing the evidence, the judge issues a final judgment, known as a civil judgment.

On the other hand, criminal court involves someone accused of breaking the law. The federal, state, or local government charges the accused party. If, after holding a trial, the defendant is found guilty or the defendant pleads guilty prior to the trial, the judge issues a criminal judgment. A sentence is issued later, which could include jail time or some other form of punishment.

Heading off a lawsuit is the best way to avoid a judgment. To do so, don’t ignore calls and correspondence from your creditor. Reach out to learn if they’ll accept suitable payment arrangements. Educate yourself on smart ways to pay debt collectors, and consider using the services of a debt management agency.

What if the loan company or debt collector has already started the lawsuit? Don’t skip court. Show up and fight. You may win if the statute of limitations has expired.

If you haven’t made a payment on an old debt for many years, you may have a successful legal defense. Most states set the time frame between four to six years. Collectors often still file suit because they win by default if you don’t show up. So, it’s important that you go to court with proof of your last date of payment.

If you successfully defeat or avoid a judgment, don’t stop there. Take some sensible steps to help you get out of and stay out of debt. Adopting these smart financial habits can also help prevent future judgment actions.

The answer depends on where you live, since state laws differ. Some states limit collection efforts to five to seven years. Others allow creditors to pursue repayment for more than 20 years. With the right to renew a judgment over and over in many states, it may last indefinitely.

Judgment renewals may be repeated as often as desired or limited to two or three times. This is another state-specific issue. Judgments can also lapse or become dormant. The creditor must then act within a specific time frame to revive it.

If you own a limited amount of property, it may all be exempt from judgment collection efforts. Also, you may not work or only work part-time. With the CCPA cap, that may mean you don’t earn enough for garnishment.

This inability to pay your debt is called being judgment proof, collection proof, or execution proof. While these circumstances exist, the judgment creditor has no legal way to collect on the debt. It’s not a permanent solution. The creditor may revisit collection efforts periodically for many years.

For a more permanent solution, you may want to consider filing bankruptcy. This process can discharge or eliminate most civil judgments for unpaid debt. Exceptions apply for things like child support, spousal support, student loans, and some property liens. Speak with a bankruptcy lawyer to learn whether this will help your situation.

If you can afford to pay a decent lump sum, you may be able to negotiate a settlement. The judgment creditor may be willing to settle if they fear you will otherwise file bankruptcy. Get the terms and settlement amount you agree upon in writing. Be sure the creditor agrees to file a satisfaction of judgment with the court after they receive your pay off.

Challenging and overturning a judgment is difficult but not always impossible. This is the case if there were errors. Perhaps you weren’t notified of the suit or it was never your debt to begin with. Consult with an attorney to find out whether you have grounds to challenge the decision.

If you want to challenge a judgment, act fast. If you received prior notice of the case, you may have up to six months to reopen it. If you weren’t notified, you likely have up to two years to appeal. By reopening the case, you have the opportunity to fight the claim anew.

For many years, credit reports included judgment information. But that changed in 2017. The National Consumer Assistance Plan is responsible for creating more accurate credit data requirements. These changes resulted in the removal of civil debt judgments from credit reports.

Judgments are still a matter of public record. But the NCAP now requires that there be identifying information on these records for more accuracy. That data includes a social security number or date of birth along with the consumer’s name and address.

Public records cannot include this type of identifying information. It would violate privacy laws. This is the reason these judgments are no longer reported on credit files.

You should receive a summons when you’re being sued. So, you can expect a default judgment will follow if you don’t show up in court. You can also expect a notification when a judgment is entered against you.

Mistakes happen, though. You may have missed the notice or moved to a new address. If that happens, you may not learn of the judgment until collection actions start.

Take action if you learn that judgments are still being reported by Equifax, Experian, or Trans Union. The NCAP eliminated this practice, so if there’s a judgment on your report, this is definitely something that you should dispute. Credit repair services, like Lexington Law Firm*, can help you challenge the errors on your behalf with the credit bureaus and request that they correct your report.

Sign Up Now

Privacy Policy

Disclosure: Credit.com and CreditRepair.com are both owned by the same company, Progrexion Holdings Inc. John C Heath, Attorney at Law, PC, d/b/a Lexington Law Firm is an independent law firm that uses Progrexion as a provider of business and administrative services.

Source: credit.com

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

Zombie debt is a broad term that refers to past debts that are still affecting you. An example of zombie debt is a three-year-old loan that should be paid off.

The term “zombie debt” refers to a past debt that shouldn’t affect you anymore yet continues to appear on your credit report. Dealing with zombie debt can be extremely complicated as debt collectors may repeatedly contact you about an account that belonged to you years ago.

Much like the characters in a post-apocalyptic story, it’s possible to overcome zombie debt with the right know-how. This guide will teach you how to deal with debt collectors and educate you on the laws relating to outstanding debt. We’ll also arm you with tools like Credit.com’s free credit report card to stave off the next wave of debt-related threats.

Key Takeaways:

Collection activities are the most common causes of a zombie debt outbreak. Here’s a step-by-step breakdown of how a buried debt might rise from the grave:

That collection agency may report the debt as owed to the three major credit reporting agencies (Equifax®, Experian®, and TransUnion®). This prompts the debt to reappear on your credit report as zombie debt.

How Do I Get Rid of Zombie Debt?

Learning how and why you have zombie debt is the first step to effectively protecting yourself. When devising your zombie debt survival plan, you should also know your .

The law is on your side in cases where a debt collector tries to revive a debt that’s past the statute of limitations. Credit dispute letters can help you challenge a debt with a collector—legally, they must halt collection activity until they provide documented proof that the debt is legal and still collectible.

In some cases, zombie debt collectors may be aggressive in their pursuit of payment. The Fair Debt Collection Practices Act (FDCPA) prevents creditors from harassing you, so consult an attorney if you believe anyone is infringing on your rights.

Remember that one of your Fair Credit Reporting Act (FCRA) rights is to have an accurate credit report. If a collection agency reports a dead debt, you may be able to dispute it.

If a judge rules that the creditor can renew the debt, it could be collectible for years. In some cases, they could hold you liable for decades.

There are a few options for dealing with this type of zombie debt. First, contact the creditor that originally secured the judgment. Work directly with them and not a secondary collection agency.

If the debt is still owed, try to negotiate a settlement. The debt is old now, and they may accept a partial payment of the balance and agree to list the collection as paid. Once that occurs, no one else can continue to take action to collect the money from you.

If you can’t afford to settle the debt or you’re dealing with several collection accounts or judgments, you might consider bankruptcy.

While you’re under the protection of bankruptcy, no creditor covered by the petition can take any action to collect from you. Once the bankruptcy is finalized, the debts are considered settled and paid off.

An encounter with zombie debt might be spooky, but it’s important to stay calm. Our guide outlined several ways to deal with this unexpected threat, but monitoring your credit can help you stave off future attacks.

Credit.com’s ExtraCredit® service helps you track activity on your credit report and address errors or other surprises if they arise. ExtraCredit can also protect you from bad actors on the internet and alert you if anyone attempts to steal your identity.

Source: credit.com

Editor’s Note: Sign up for CNN’s Meanwhile in China newsletter, which explores what you need to know about the country’s rise and how it impacts the world.

China’s central bank has cut its key mortgage reference rate by a record amount, as it ramps up efforts to stem a prolonged property crisis.

The People’s Bank of China (PBOC) announced Tuesday that it would cut its five-year loan prime rate (LPR) from 4.2% to 3.95%, while keeping the one-year LPR unchanged at 3.45%.

The 25 basis point cut to the five-year LPR is the biggest reduction the central bank has made since it revamped its LPR system in 2019. That August, the central bank announced that the LPR would become the new reference rates for lending by Chinese banks.

The latest cut was also the first reduction to the five-year LPR since June 2023.

The LPR is the rate at which commercial banks lend to their best customers. The five-year rate usually serves as a reference for mortgages.

“Today’s 25 (basis point) cut to the five-year LPR is clearly aimed at supporting the housing market,” analysts from Capital Economics said in a note on Tuesday.

“On its own, it will not revive new home sales. But coupled with efforts to provide increased credit support to developers, today’s cut should help to reduce pressure on the property sector somewhat,” they said.

China’s economy has been hobbled by a real estate downturn since 2021, when a government crackdown on developers’ borrowing triggered a liquidity crisis in the sector.

The property market has since entered a prolonged slump, marked by an ongoing decline in both investment in and sales of property. Dozens of major developers have defaulted on their debt, with Evergrande, once the country’s second largest homebuilder, ordered to liquidate last month.

The crisis has triggered widespread protests by unpaid construction workers, buyers of unfinished homes and frustrated investors facing financial losses. It has also spilled over to the country’s massive shadow banking industry, with Zhongrong Trust declaring itself severely insolvent last year after failing to repay its debt.

Beijing has scrambled to revive the property sector, which accounts for as much as 30% of China’s gross domestic product.

Measures unveiled include slashing interest rates, reducing the size of down payments, encouraging banks to extend maturing loans to developers and loosening restrictions on home purchases in Chinese cities.

China’s economy faces a litany of other problems, including deflation, low confidence and accelerated capital flight.

The country’s direct investment liabilities, a measure of foreign direct investment, reached $33 billion in 2023, according to data released by the State Administration of Foreign Exchange on Sunday.

The gauge, which measures direct investments by foreign-owned entities in China, was down 82% from 2022 and stands at its lowest level since 1993.

While an uncertain economic outlook and rising geopolitical tensions are partly to blame for the exodus, foreign companies and investors have also grown wary of increasing political risks in China, including the possibility of raids and detentions.

The country’s stock markets have suffered a prolonged slump since their recent peaks in 2021, with more than $6 trillion in market value having been wiped out from the Shanghai, Shenzhen and Hong Kong markets.

Source: cnn.com

Mortgage industry analysts have been watching and waiting to see what the Federal Reserve will do—or say—next about rate cuts. They’re hedging their bets that the Fed will cut rates this year and, as an indirect result, mortgage rates will fall, too, and help revive the housing market.

Watch for coverage of today’s Fed meeting in RISMedia’s Daily News tomorrow.

Economic data plays a key role in the Fed’s timing, though. A key performance metric Fed officials and economists watch is the personal consumption expenditures (PCE) price index, which measures core inflation.

PCE inflation (excluding food and energy costs) rose 0.2% in December from November’s 0.1%, and increased 2.9% from a year ago, according to data released Friday from the U.S. Commerce Department.

The annual rate of core inflation in December fell from 3.2%. That’s the lowest annual rate in nearly three years. Additionally, gross domestic product (GDP) grew at a pace of 3.3% in the fourth quarter, surpassing market expectations.

These strong economic readings pushed the 10-year Treasury yield, which mortgage rates tend to track, up to 4.14% on Friday before flattening later in the day.

Fed officials have hinted in recent speeches that cooling inflation supports the case for rate cuts—but at a more measured pace than before.

As for how those cuts will drive mortgage rates, expect “slow and steady declines,” likely in the latter half of the year, said Odeta Kushi, deputy chief economist with First American Financial.

“The Fed wants to see the long and variable lags of monetary policy so they can make their way through the economy before deciding on any rate cuts,” Kushi told RISMedia, noting that anything can happen between now and the end of the year to change the Fed’s stance. “I think that the Fed has emphasized that the path to rate cuts is highly uncertain, and they’re going to take a sort of data-driven, cautious approach.”

Fed officials’ comments temper rate-cut expectations

Several Fed officials have signaled a more cautious approach to rate cuts, dimming investors’ hopes of quick action.

During a virtual speech to the Brookings Institution on Jan. 16, Federal Reserve Governor Christopher Waller said he believes the Fed’s restrictive monetary policy is “set properly” to bring down core inflation closer to the Fed’s target of 2%. However, Waller isn’t in a rush to cut rates until inflation not only reaches the Fed target rate, but stays there for a prolonged period.

“When the time is right to begin lowering rates, I believe it can and should be lowered methodically and carefully,” Waller said in his speech. “In many previous cycles, which began after shocks to the economy either threatened or caused a recession, the FOMC cut rates reactively and did so quickly and often by large amounts.

“This cycle, however, with economic activity and labor markets in good shape and inflation coming down gradually to 2 percent, I see no reason to move as quickly or cut as rapidly as in the past.”

It didn’t take long for the markets to react to Waller’s comments. The 10-year Treasury yield jumped sharply after his speech by about 30 basis points since late December and is currently hovering near 4.1% after reaching a recent low at about 3.8%.

In separate remarks earlier this month, Fed Governor Michelle Bowman, who tends to be more hawkish, said a sustained march toward the 2% inflation goal will make it more likely to lower rates to prevent the Fed’s monetary policy from being too restrictive.

“In my view, we are not yet at that point. And important upside inflation risks remain,” Bowman said in her remarks, adding that she was still willing to raise the Fed funds rate in the future if inflation stalls or ticks up again. “Restoring price stability is essential for achieving maximum employment and stable prices over the longer run.”

Mortgage industry looks to rate cuts to help spur loan activity

2023 was a painful year for housing. As mortgage rates soared near the 8% mark, existing-home sales cratered to their lowest level last year (4.09 million) since 1995 even as median home prices reached a record high of $389,800, according to data from the National Association of Realtors.

Hobbled by anemic loan originations and next-to-no refinance activity, mortgage lenders aggressively cut staff last year (especially back-office positions like underwriters and loan processors). Others merged with bigger players with strong cash positions. And some lenders threw in the towel altogether, closing up shop.

“Our data shows that your typical independent mortgage banker trimmed their employee count by more than 40% from the peak in 2021 to the most recent data points,” Mike Fratantoni, chief economist with the Mortgage Bankers Association, said in an interview with RISMedia.

Fratantoni said mortgage volume will be somewhat higher in 2024 in tandem with higher sales of new and existing homes. However, potential homebuyers—especially those with the headwind of having record-low mortgage rates—may be hesitant to make a move until rates hit a certain sweet spot.

“As we get to the low (6% range) at the end of this year and below 6% next year…that’s going to be enough to get people’s attention,” Fratantoni said.

Melissa Cohn, regional vice president of William Raveis Mortgage, points to a Fed rate cut as being a positive signal to potential homebuyers of an improving market. However, Cohn added that a notable drop in mortgage rates will likely push home prices higher due to higher demand, so buyers shouldn’t stay on the sidelines too long.

Source: rismedia.com

Mortgage rates ticked up last week after weeks of declines while applications for home loans dropped in a sign that the housing market continues to struggle despite some recent signs of optimism.

The 30-year fixed rate inched closer to 7 percent for the week ending December 29, according to the Mortgage Bankers Association (MBA). Meanwhile, mortgage applications tumbled by more than 9 percent from two weeks earlier, lenders said.

“Markets continued to digest the impact of slowing inflation and potential rate cuts from the Federal Reserve, helping mortgage rates to stay at levels close to the lowest since mid-2023,” Joel Kan, MBA’s deputy chief economist, said in a statement shared with Newsweek on Wednesday.

The 30-year fixed mortgage ended 2023 at 6.76 percent, more than a percentage point lower than the peak of nearly 8 percent in October, he said.

“The recent decline in rates has given the housing market some cause for optimism going into 2024, but purchase applications have not yet picked up in response, with the overall level of purchase activity 12 percent lower than a year ago,” Kan said.

Economists say that activity in the housing market will ramp up if prices decline, which at the moment are elevated partly due to low supply. The existing homes market is still in the doldrums as sellers are reluctant to give up their low rates for new home loans that could cost them close to 7 percent in interest.

“The housing market has been hampered by a limited supply of homes for sale, but the recent strength in new residential construction will continue to help ease inventory shortages in the months in come,” Kan said.

Recent data shows that private residential construction moved up, according to the U.S. Census Bureau, to nearly $900 billion in November—a jump of more than a percent from the previous month, helped by spending on single-family home building.

“November was the first month in over a year when single-family construction spending rose compared to the year prior,” Yelena Maleyev, KPMG’s senior economist, said in a note shared with Newsweek on Tuesday. “Builders have become more positive about the single-family market as mortgage rates have come down from recent peaks and revived buyers’ interests.”

In a sign that rates may be entering some level of uncertainty, as the market looks to see how many rate cuts the Fed will institute in 2024, the average contract interest rate for 15-year fixed-rate mortgages decreased to 6.26 percent from 6.41 percent in the week ending December 29.

Fed policymakers held rates at 5.25 to 5.5 percent last month for the third time in a row and have suggested that they may cut rates to a possible 4.6 percent in 2024. It’s unclear yet when such cuts could come.

But declining mortgage rates could give a boost to the housing market, with builders feeling optimistic in the new year.

“Construction activity remains robust as strong demand for housing and infrastructure remain a tailwind for builders,” Maleyev said, noting that elevated rates could be a challenge for the sector in 2024. “Spending is expected to end the year on a high, with lower mortgage rates helping revive activity in the housing market.”

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Source: newsweek.com

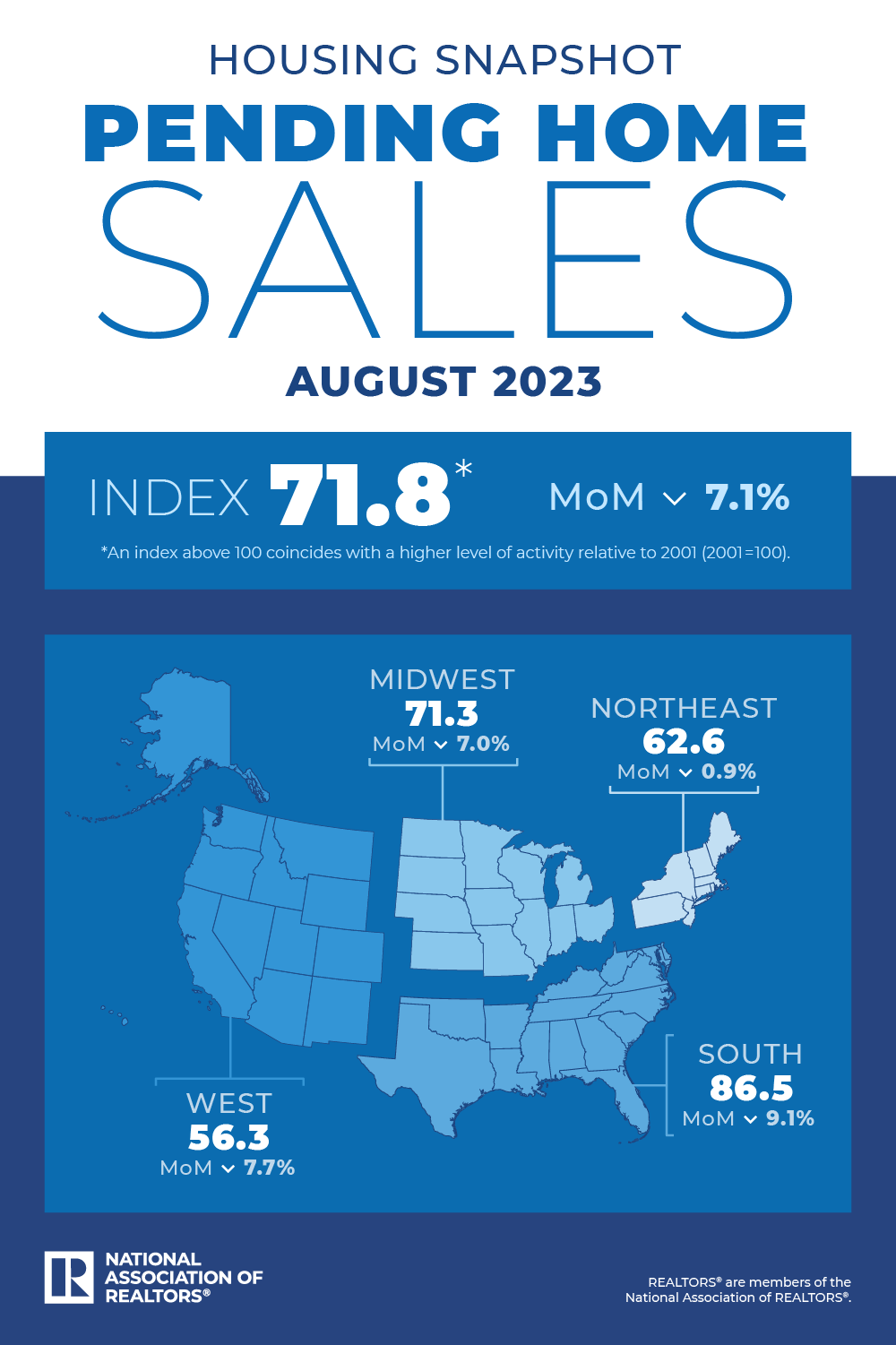

The National Association of REALTORS® reported Thursday that contract signings tumbled 7.1% month over month in August as mortgage rates float above 7%, pushing many aspiring home buyers to the sidelines. All four major U.S. regions saw monthly decreases, according to NAR. Pending home sales are down 19% from a year earlier. “It’s clear that increased housing inventory and lower interest rates are essential to revive the housing market,” says NAR Chief Economist Lawrence Yun.

Mortgage rates have been rising above 7% since August, which has diminished the pool of home buyers, Yun says. “Some would-be home buyers are taking a pause and readjusting their expectations about the location and type of home to better fit their budgets.”

Home shoppers also are grappling with higher home prices. The median price nationwide for an existing home rose nearly 4% year over year in August and has held above $400,000 for three consecutive months, according to NAR data.

New-home sales, which were a bright spot for the housing market recently, also dropped nearly 9% last month to their weakest level since March. Builders blamed elevated mortgage rates and challenging affordability conditions for the decline.

“Builders continue to grapple with supply-side concerns in a market with poor levels of housing affordability,” says Alicia Huey, chairperson of the National Association of Home Builders. “Higher interest rates price out demand, as seen in August, but also increase the cost of financing for builder and developer loans, adding another hurdle for building.”

Housing affordability fell in July as monthly mortgage payments climbed 18.4%, according to NAR’s latest Affordability Index. (At the time of the index’s last reading, mortgage rates were 6.92%.) At the same time, the median family income increased only 4.4%. The index showed that the typical family nationwide couldn’t afford a median-priced home.

In recent weeks, mortgage interest rates have reached the highest level since 2000, prompting loan demand to sink to a 27-year low, the Mortgage Bankers Association reported this week.

At its meeting last week, the Federal Reserve voted to pause increases to its benchmark interest rate but hinted at another hike before the end of the year.

“Overall, [mortgage] applications declined as both prospective home buyers and homeowners continue to feel the impact of these elevated rates,” says MBA Economist Joel Kan. Mortgage applications to purchase a home last week fell 27% lower than the same week a year ago, MBA reports.

“The Federal Reserve must consider the sharply decelerating rent growth in its consideration of future monetary policy,” Yun says. “There is no need to raise interest rates. Moreover, the government shutdown will disrupt some home sales in the short run due to the lack of flood insurance or delays in government-backed mortgage insurance.”

Source: nar.realtor

Pending home sales failed to add a third month onto the mini rally it staged in June and July. The National Association of Realtors® (NAR) said its Pending Home Sale Index (PHSI) declined 7.1 percent to 71.8 in August and is now down 18.7 percent from its August 2022 level.

The PHSI ended a three-month decline in June, rising 0.3 percent followed by a 0.9 percent increase in July.

The PHSI is based on contracts signed during the month to purchase existing single-family houses, condos, and cooperative apartments. It is a leading indicator of those sales which are expected to close over the following 30 to 60 days. NAR will report September’s existing sales on October 19.

“Mortgage rates have been rising above 7 percent since August, which has diminished the pool of home buyers,” said Lawrence Yun, NAR chief economist. “Some would-be home buyers are taking a pause and readjusting their expectations about the location and type of home to better fit their budgets.”

“It’s clear that increased housing inventory and better interest rates are essential to revive the housing market,” added Yun.

The index in all four of the nation’s major regions declined compared to both July and to the prior August. The Northeast PHSI was down 0.9 percent to 62.6 and was 18.2 percent lower on an annual basis. The index for the Midwest lost 7.0 percent and 19.1 percent compared to the two earlier periods to a reading of 71.3.

Pending sales in the South fell 9.1 percent to 86.5 in August, coming in 17.6 percent lower year-over-year. The West’s PHSI declined 7.7 percent to 56.3 and was 21.4 percent behind its August 2022 reading.

Yun concluded, “The Federal Reserve must consider the sharply decelerating rent growth in its consideration of future monetary policy. There is no need to raise interest rates. Moreover, the government shutdown will disrupt some home sales in the short run due to the lack of flood insurance or delays in government-backed mortgage issuance.”

The PHSI was benchmarked at 100 in 2001, a number equal to the average level of contract activity during that year.

Source: mortgagenewsdaily.com

Back in the 2000s, one of the most popular stays when traveling to the scenic Santa Rosa Beach in Florida was owned by none other than Vera Bradley co-founder, Barbara Bradley Baekgaard.

The boutique-style, 9-room inn prominently featured Vera Bradley’s signature floral designs throughout, attracting both fans of the famous design brand, as well as travelers looking to cozy up for a while in its charming rooms.

A 30A landmark, sitting merely steps away from the town square and beaches where the 1998 movie The Truman Show was filmed, the property once known as the Vera Bradley Bed and Breakfast attracted tourists from all over the country with its themed rooms and proximity to one of the most captivating beaches on the Gulf Coast.

In line with Vera Bradley’s playful designs, the inn’s rooms had colorful themes like key lime, true blue, posies, sunset patterns, checkerberry, and more.

And older reviews from travelers who stayed at the inn say their stay often included a colorful Vera Bradley bag that matched their room — and was theirs to keep.

But the magic was gone in 2012 when Barbara Bradley Baekgaard sold the inn.

Since then, despite several attempts to revive the inn to its former glory, the home fell into foreclosure in 2011.

Typically, it would’ve been torn down and replaced with a larger and more modern structure, but luxury agent Cindy Cole of Corcoran Reverie had other plans to save a piece of town history — and restore it to its former glory.

She reached out to the current owners who jumped at the opportunity to do some good for the town where they loved to vacation.

They then spent years lovingly restoring the Vera Bradley Inn to a more current look and feel, while keeping tasteful antique touches in honor of its historical significance and repurposing it for residential use. And the transformation is spectacular! (scroll down for some “before-and-after” pictures, to get a better idea of how it looked like prior to the makeover).

SEE ALSO: Mar-a-Lago Neighboring Mansion Sells for a Whopping $50 Million

Now, the antebellum-style property is being brought to market as an extra-charming residential home, priced at $6,495,000.

“With this being one of the most iconic homes in Seaside based on its history and prominent location, I’m thrilled to bring this home to the market,” says owner and broker, Hilary Farnum-Fasth of Corcoran Reverie, who holds the listing alongside Cindy Cole.

Prior to its recent transformation, the property located at 38 Seaside Avenue boasted a charming yet outdated design that didn’t bode well with current interior trends.

Despite the appeal of the playful Vera Bradley-inspired designs that adorned its walls, the former inn was in dire need of upgrades.

But the current owners have spent years lovingly restoring the Vera Bradley Inn to a more current look and feel, while keeping tasteful antique touches in honor of its historical significance.

During the restoration process, the owners preserved the original flooring, staircase, fireplaces, and some furnishings from the inn, creating a warm and inviting feel.

And thanks to some old listing photos, we can see how some of the rooms inside the former Vera Bradley Bed & Breakfast have been transformed to accommodate its future residents.

The property at 38 Seaside Avenue in Santa Rosa Beach, Florida is now being brought to market as a single-family residence — though it can also be operated as a vacation rental, rebranded as the Feeling Good Again manor.

With a total of 5,476 square feet, 9 bedrooms, and 12 baths spread across the main residence and the separate carriage house (which features 2 guest suites, separate kitchenettes, and separate sitting rooms), there’s ample space to entertain (or host) guests.

The antebellum-style home has been equipped with everything it might need to serve as a loving family home including an updated, modern gourmet kitchen complete with a Thermador range and marble countertops.

However, future owners might still want to take advantage of the property’s earning potential. If not for the association with the Vera Bradley brand, for its short-lived on-screen presence in one of the most popular movies ever made: the house was featured as the backdrop for a scene in the 1998 movie The Truman Show, starring Jim Carrey.

In the scene, the house is lit up to help the townspeople find Truman. Unsurprisingly, the property is one of many places from the film that people still visit today — adding to its appeal as a lucrative vacation rental.

More stories

A $22 Million penthouse unit lists at the famed Fontainebleau Resort in Miami Beach

Serena Williams’ house in Florida has many unique features, but no living room

A $4.2M Florida home with cool ’80s vibes and Miami Vice credits hits the market

Source: fancypantshomes.com