Buying a home is one of the most expensive purchases you’re bound to make in your life. That’s why it’s so important to get the right mortgage before you sign on the dotted line.

A few differences in mortgage rates or other terms can equate to tens of thousands of dollars either spent or saved. But with so many options available on the market, it’s hard to know where to start.

There are traditional lenders and online mortgage lenders, local ones and large multinational ones. Plus, many lenders specialize in different types of loans.

To get started, browse some of the best mortgage lenders and find a few that match your needs.

Best Mortgage Lenders & Online Loan Marketplaces of 2023

You have several great options available, from online lenders to brick and mortar branches, from excellent credit to bad credit lenders. Check out the complete list of lenders to find the best choice for your next home loan.

loanDepot

Offering home loans in all 50 states, loanDepot works with a wide range of borrowers. The minimum credit score for most loans is 620. However, some government-insured programs may allow your credit score to be as low as 580.

You also have access to various mortgage options. They provide fixed and adjustable-rate mortgages, jumbo mortgages, FHA loans, VA loans, and home equity loans.

If you want to talk over these choices, you’ll appreciate the online lender’s no steering policy. That means your loan officer doesn’t receive any incentive to point you in any one specific direction, so you can trust the advice you get.

Do keep an eye on your origination fees. Depending on your application, those could cost you anywhere between 1% and 5% of your home’s purchase price.

The first step of applying for a mortgage is talking to a loan officer. However, the application process occurs online. That means you can do the bulk of the work at your convenience.

Read our full review of loanDepot

LendingTree

LendingTree is the best if you want to compare multiple offers as they partner with the largest network of lenders who compete for your business.

You can get up to five different loan offers within minutes of submitting your application. If you’ve already found the place you want to call home, start here.

Another great feature is that you can submit a request online for conventional, FHA, or VA loans. LendingTree’s website also provides many in-depth resources for first-time buyers, regardless of where you are in the process.

They provide tips for qualifying for a mortgage, mistakes to avoid when purchasing a house, and a bank of frequently asked questions. For home loan guidance and receiving multiple offers at once, LendingTree is the place to go.

Read our full review of LendingTree

Rocket Mortgage

Rocket Mortgage is a great pick if you prefer applying for a mortgage online and has excellent customer service when needed.

Rocket Mortgage provides FHA loans, USDA loans, and Freddie Mac and Fannie Mae loan products that come with down payments as low as 3%.

A branch of Quicken Loans, Rocket Mortgage’s online application process is highly streamlined with an approval time of just a few minutes. You can also avoid the hassle of paperwork by using a secured platform to share your financial information.

Once you have your proposed interest rate, you can test out different house prices and down payment amounts to create a customized monthly payment. Once you get a contract on your new home, closing is easy and takes place at a location of your choice.

Read our full review of Rocket Mortgage

New American Funding

New American Funding offers conventional, FHA, and VA loans. You can also explore options for a mortgage that includes a home renovation loan.

Less common available loans include jumbo loans, reverse mortgages, and interest-only mortgages.

New American Funding also has first-time homebuyer loan programs available and works with down payment assistance programs in 14 states, including California, Illinois, Florida, and Texas.

Once you have an idea of what you’re looking for, go step-by-step through their questionnaire to get more details on potential loan terms you could qualify for.

Read our full review of New American Funding

Alliant Credit Union

Alliant Credit Union offers both fixed and adjustable-rate mortgages, and you can qualify with a down payment as low as 3% of the home price.

On a $200,000 house, that equates to just $6,000 needed in cash for your down payment.

You can qualify anywhere in the country and enjoy a low origination fee of just $995. If having cash on hand is an issue for you when purchasing a home, check out Alliant to see how they stack up to other mortgage lenders.

Alliant also offers home equity lines of credit.

Read our full review of Alliant Credit Union

Guaranteed Rate

Guaranteed Rate originated about $24 billion in mortgages for 2018, which is no surprise. The website allows you to get an idea of your qualifying interest rates easily.

All you need to do is input just a few details about your estimated credit score and the type of home you’d like to buy.

You can then browse several loan options to see your interest rates and APR options. It’s easy to compare mortgage options to get an idea of which kind of mortgage is best for you.

You can also browse their Knowledge Center for tons of in-depth resources on the home buying process.

Read our full review of Guaranteed Rate

First Internet Bank

Solely based online, First Internet Bank is an online mortgage lender that allows you to complete the entire mortgage application from your own home.

However, you can still call to talk to them on the phone whenever you’d like. First Internet Bank also offers a wide range of loans, including conventional, jumbo, FHA, VA, USDA, and home equity loans.

You can get a personalized mortgage rate in less than a minute. You can even sign up for email alerts to track mortgage rates as you shop for houses.

Getting prequalified takes just moments, and you can then submit the appropriate loan documents to get pre-approved. This extra step gives you a leg up on the competition once you’re ready to make an offer on a home.

Read our full review of First Internet Bank

Carrington Mortgage Services

If you have a question about a loan, you can chat with a Carrington representative from 7 a.m. until 6 p.m. PST. They’ve even been featured on Lifetime’s Designing Spaces.

So, it should go without saying that Carrington is available, and they want your business. Peruse their website, and you’ll see how user-friendly it is within moments.

They have a list of mortgage tools that will help you understand what you can afford. They also have a step-by-step guide outlining the loan application process.

Additionally, you’ll find a list of common mortgage terms that banks use, an explanation of loan types, and a mortgage application checklist.

Carrington is a top-notch mortgage company with an intuitive, user-friendly interface and great rates to boot.

Read our full review of Carrington Mortgage Services

Truist

Truist has a significant online presence for mortgages in addition to its physical branches throughout the country.

You can create an online account to apply for a mortgage loan or enter your zip code to find a location near you. Truist offers a suite of mortgages on top of the typical government-backed loans, including high-cost home financing.

Alternatively, if you meet certain income eligibility requirements, you may qualify for a HomeReady/Home Possible loan, which can help make homeownership more affordable.

Truist also offers a unique program for doctors to help licensed medical interns, residents, and fellows qualify for a mortgage.

Read our full review of Truist

U.S. Bank

Prequalify online within minutes, and from there, you can start making intelligent decisions about your future home. U.S. Bank offers conventional, fixed-rate loans, VA loans, ARMs, and FHA loans.

Want to design and build your dream home? They even have new construction loans and investment property loans.

They also have a “loan officer near you” app that lets you speak with someone who’s knowledgeable about your area and what it is specifically you’re looking to purchase.

You can also call their national number directly and someone will speak to you right then and there. U.S. Bank even has a FAQ section that answers questions you didn’t even know you had.

Read our full review of U.S. Bank

Other Top Mortgage Lenders to Consider

Didn’t find one on the list that you liked? Read our reviews of some other good lenders:

How to Find the Best Mortgage Lender

To find the best mortgage lender, it’s wise to compare mortgage rates and terms from multiple lenders. This will help you find a lender that offers the best deal. The lending standards may be similar across lenders, but the way they implement them may vary.

You might be surprised at how much variation you see in your different offers. Plus, mortgage loans can be structured in various ways to accommodate your financial situation or personal preferences.

If you don’t have a lot of spare cash on hand, you may be able to pay a higher interest rate to avoid higher closing costs. If you want to lower your monthly payments, your lender may let you pay for points to qualify for a lower rate.

It’s also helpful to understand where mortgage rates are right now and where they’re headed. A good real estate agent may be able to help you with this as they usually know the market quite well.

Know your credit score and the type of rate you should qualify for so you can negotiate the best deal possible. Some credit card issuers give you your FICO score for free.

How to Compare Mortgage Lenders

Here are some questions you may want to ask when searching for the best mortgage lenders:

- How is their customer service?

- What can they tell you about their closing costs and other associated lender fees?

- How much do you need for a down payment?

- How quickly can you close once you find a home?

These are all questions you should pose to at least two or three separate mortgage lenders.

Compare answers and determine which lender can offer you the best financial deal and meet any other expectations you have surrounding the loan process.

What should you look for in a mortgage lender?

Finding the best mortgage lender for your needs can take a while, so give yourself time. If you’re interested in a particular type of loan, such as a VA loan or an FHA loan, make sure the lender actually offers it.

Mortgage Interest Rates

Pick at least two or three mortgage lenders with good customer satisfaction ratings to compare pre-qualification offers. Then, take a look at the interest rates they offer you, whether the rate is fixed or adjustable, and what your monthly mortgage payments will be.

Taxes and Mortgage Insurance

Make sure they include an estimate for taxes and mortgage insurance, not just your principal and interest because that can make your payment increase by at least a couple hundred dollars.

Property Taxes

If you live in a more expensive area like a major city, expect to pay even more for property taxes. Of course, you can always refinance to get a lower rate down the road, but it’s expensive because of closing costs.

Fees and Closing Costs

Next, compare the closing fees of each mortgage lender. Some of the expenses won’t change from lender to lender. A title search, for example, will cost about the same amount regardless of what lender you go through. Origination fees, on the other hand, can vary greatly.

Expect to pay 3% to 5% of the loan amount for total closing expenses. Which end of the spectrum you end up on can make a huge difference in how much cash you’ll need.

A good lender will help you explore your options based on how much cash you have and how long you plan to be in the home.

Mortgage Points

If you have extra money and intend to make your new place your “forever home,” it may be worth paying extra points at closing in exchange for a lower mortgage rate. Ask each lender for different scenarios to see which best fits your individual needs.

How can you get pre-qualified for a mortgage?

There are two ways to start the mortgage process: a pre-qualification and a pre-approval.

Getting prequalified is an informational step to get an idea of what rates to expect and how much you can borrow based on your income and debt levels. You don’t have to supply any documentation at this time.

The quotes you receive are not set in stone and are subject to change with your official application. But it’s good to find out what types of loans you should consider, how much cash you’ll likely need, and what price range of home you should look at.

You’ll need more to actually make an offer on a home because most sellers don’t view a pre-qualification as official enough to indicate likely financing.

What is a pre-approval letter?

A pre-approval letter takes the pre-qualification process one step further. You essentially submit your entire application and all the accompanying documentation.

This includes things like your tax returns from the last two years, bank statements, explanations of any negative remarks on your credit history, and employment verification.

The mortgage lender also performs a hard credit pull to determine your mortgage interest rate. It takes a bit of time, but once you’ve been pre-approved, the lender provides a letter stating how much of a loan you qualify for and how much down payment you can provide.

When you submit an offer on a house, this addition makes it much stronger because the seller knows that you’re likely to get approved for the mortgage. Once your offer is accepted, you can lock in an interest rate with your mortgage lender for a certain number of days.

What type of mortgage should I get?

Some quick introspection is necessary to answer this question. Start by examining your financial position, household needs, and long-term goals. How secure is your income? Where do you want to live in the next few years? How much money can you raise for the down payment?

Answering these questions helps you pick the most appropriate mortgage type for you. Typically, the choice boils down to a conventional or government-backed mortgage. Conventional home loans have stricter requirements, such as a high credit score and sizable down payments. Government-backed loans allow lower credit scores and little to no down payment to qualify.

There are eight different types of mortgages spread across the two categories. Dig in as we explore each of them below.

8 Types of Mortgage Loans

Conventional Mortgage Loans

Conventional mortgages are home loans that the government doesn’t insure and fall into two categories: conforming and non-conforming.

A conforming loan means the loan falls within limits set by the Federal Housing Finance Agency. Non-conforming loans, such as jumbo loans, exceed the FHFA limit, which varies between counties.

Conventional Loan Requirements

Conventional loans have stringent credit score and debt-to-income ratio requirements. Mortgage lenders approve borrowers with a credit score of at least 620 and a 20% down payment. Buyers who can put at least 3% down may also be eligible but must pay primary mortgage insurance.

Pros

- Cheaper than unconventional loans

- Can qualify by putting 3% down

Cons

- PMI on deposits less than 20%

- Strict credit score and DTI ratio requirements

Best for: Buyers with large down payments, high income, stellar credit scores, and excellent credit history.

Fixed-Rate Mortgage

A fixed-rate mortgage is a home loan that carries a fixed interest rate over its lifespan. Once the interest rate is locked in, it’s not affected by changes in market rates.

Fixed-rate mortgages are the most popular home loans, thanks to their predictability. Knowing your mortgage payment every month helps borrowers more easily plan their finances. As a result, you can be sure that there are no surprises month-to-month.

Fixed-Rate Mortgage Loan Requirements

Lenders use your credit score, debt-to-income ratio, credit history, income, and down payment to determine eligibility and set mortgage rates. Credit scores are a primary determinant, and most mortgage lenders approve borrowers with scores above 620.

Credit scores above 740, low DTI ratio, stellar credit history, and a significant down payment command the most competitive mortgage rates. Conversely, low credit scores lead to higher interest rates, and a down payment of less than 20% triggers the need to pay private mortgage insurance (PMI).

Fixed-rate mortgage terms range from 10 to 30 years, but 30 and 15-years loans are most popular. The length of your mortgage also determines the interest rates and monthly payments.

Pros

- Predictable monthly payments

- Nonfluctuating interest rates

- Easy qualifications

- Large tax deductions

Cons

- Higher mortgage rates

- High-interest amount

- Slow equity growth

Adjustable-Rate Mortgage

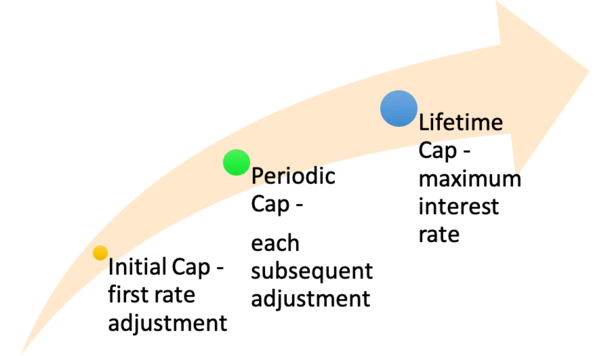

As the name suggests, adjustable-rate mortgages carry an adjustable interest rate set by the prevailing market rate. An ARM starts with a fixed interest rate for a few years then changes to a variable rate for the remaining loan term.

An ARM can be locked for one, three, five, seven, or ten years, but 5/1 ARM loans are most common. With a 5/1 ARM, the interest rate is locked for the first five years and then adjusted annually for the remainder of the term.

Typically, the interest rate on an ARM adjusts upwards because the initial interest rate is often lower than the prevailing market rate.

Pros

- Predictable and low initial monthly payments

- You can save a considerable amount of money at first

Cons

- Increased mortgage rates

- Monthly payments can be expensive

Best for: Borrowers who are likely to secure a pay hike in the future but want to lock in lower rates when their income is lower.

FHA Mortgage

An FHA loan is a mortgage guaranteed by the federal government and insured by the Federal Housing Administration (FHA). You can only secure an FHA loan from an FHA-approved lender. The agency insures home loans are issued by accredited lenders such as credit unions, banks, and mortgage companies, protecting mortgage lenders if a borrower defaults on payment.

FHA Loan Requirements

These loans help modest-income households buy a home. You need a 3.5% down payment, a credit score of 580 or higher, and a DTI less than 50 to qualify for an FHA loan. You can be eligible with a 500 credit score if you raise a 10% down payment.

Since the government insures FHA loans, FHA lenders can extend favorable terms to people who wouldn’t otherwise qualify for a mortgage. FHA loans carry a mortgage insurance premium (MIP) for at least 11 years, and FHA mortgages with less than 10% down must carry FHA insurance over the life of the loan.

You can use an FHA to buy or refinance a condo, single-family home, 2 to 4-unit multi-family home, and select manufactured homes. In addition, some FHA loans can finance new construction and home renovation.

The limits on FHA loans vary by county, and as of 2021, you can borrow between $420,860 and $970,800. Your county’s living costs determine the limit on FHA loans.

Pros

- Requires a 3.5% deposit

- High loan limits

- Accommodates low credit scores

Cons

- Mandatory mortgage insurance

- Only finances primary residence

Best for: Low and moderate-income households and borrowers without a large down payment.

VA Mortgage

VA loans are guaranteed by the U.S. Department of Veteran Affairs but issued by private lenders such as mortgage companies, banks, and credit unions. VA loans help veterans, current service members, and eligible spouses buy a home without a down payment.

The government guarantee allows VA accredited lenders to extend favorable terms to borrowers without a deposit. Although VA loans carry attractive terms, they have stringent qualification requirements. Only qualified active-duty service members, veterans, and surviving spouses can apply for VA loans.

VA Loan Requirements

While a VA loan offers 100% financing when buying a home, VA lenders will consider credit score, DTI, and income level when issuing a loan. There are no minimum credit score requirements, but you typically need a credit score of at least 620 to qualify.

In addition, veteran and surviving spouses can only use a VA loan to finance their primary residence. But active-duty service members can use the loan to buy a second home if they plan to move into it within 60 days of closing.

Your county of residence determines the VA loan limit. As of 2021, the county limit on VA loans ranges from $548,250 to $822,375, depending on the cost of living. However, you can get a VA loan that exceeds the county limit if you make a down payment.

Pros

- No down payment

- Competitive mortgage rates

- Lower closing costs

- No private mortgage insurance

Cons

- Can’t finance an investment property or vacation home

- Carries a VA loan funding fee

- Strict property requirement

Best for: Eligible veterans, active-duty service members, and surviving spouses.

USDA Mortgage

USDA loans are zero-down payment government-backed mortgages guaranteed by the U.S. Department to help rural homebuyers. The loans help people with modest incomes who can’t buy homes using traditional mortgages.

USDA home loans are offered under the USDA loan program or USDA Rural Development Guaranteed Housing Loan Program. The program aims to bolster the economy and improve the quality of life for people in rural America. It waives the down payment, offers competitive mortgage interest rates, and is highly accessible.

You can apply to any of the three USDA loan programs, including:

- Loan guarantees: The USDA guarantees a mortgage issued by a local lender. That allows you to access a loan with attractive terms without a deposit.

- Direct loans: These are subsidized home loans for low and very low-income borrowers with interest rates as low as 1%.

- Home improvement loans and grants: These are loans or outright grants to help homeowners upgrade or repair their homes. Some loan packages pair the loan with grants of up to $27,000.

USDA Loan Requirements

Qualifying for a USDA-backed home loan depends on the income and size of your household. The income limits vary by location and depend on your county of residence. Only U.S. citizens or permanent residents can use these loans to finance an owner-occupied primary residence.

You can qualify for a USDA mortgage with a credit score of 640 or higher, a DTI of less than 41%, and if the monthly repayment won’t exceed 29% of your monthly income. The USDA may consider a higher DTI for applicants with credit scores above 680. Applicants with scores lower than 640 may still qualify but are subject to more stringent borrowing conditions.

You also need to demonstrate a dependable income over two years, have a good credit history, and have no account in collection within the last year.

The USDA loan limit is a moving target that varies between counties, based on the cost of living. The loan can be as high as $500,000 in high-cost counties like Hawaii and California and $100,000 in rural America.

You can only access a direct loan from the USDA if your home is less than 2,000 square feet and has a market value below your county loan limit. The USDA program excludes metropolitans but covers some suburbs.

Pros

- 100% financing

- Ultra low fixed interest rates

- Includes financial grants

- No private mortgage insurance

Cons

- Geographical restrictions

- Finances single owner-occupied residences

Best for: Borrowers with limited financial resources or those wishing to live in rural areas.

Jumbo Mortgage

Jumbo loans finance homes that exceed the FHFA limits of a conventional mortgage. Jumbo loans are considered non-conforming mortgages and are considered high-risk loans.

Since they exceed the FHFA limits, Freddie Mac and Fannie Mae do not guarantee jumbo loans. That means the mortgage lender may incur losses if the borrower defaults. Jumbo loans can carry an adjustable or fixed interest rate and have strict requirements.

Jumbo Loan Requirements

You need a credit score of 700 to 720, a DTI of less than 45%, and plentiful cash reserves in the bank to qualify for a jumbo loan. Lenders require extensive documentation to show excellent financial standing. You’ll need W-2s, complete tax returns, and 1099s as well as your investment accounts and bank statements.

The minimum down payment on jumbo loans is often higher than traditional loans because they lack a government guarantee. Most mortgage lenders require a 10% to 30% deposit. Jumbo mortgage rates depend on your finances and your lender.

Some lenders charge higher rates on jumbo loans than conforming ones, while others offer lower rates. The closing costs and lender fees on a jumbo loan are often higher because of extra qualifying steps and the high loan amount.

You can use a jumbo loan to buy a home, refinance an existing mortgage for cash-out purposes, or purchase an investment property and land. However, since FHFA doesn’t govern jumbo loans, the loan limit could run into the millions.

Pros

- Higher loan limits

- Can finance investment property

- Competitive interest rates

- Flexible uses

- High loan amounts

Cons

- Requires high credit scores

- You need high income

- Requires plenty of cash reserves

Best for: People buying expensive property and homeowners looking to refinance a large loan.

Interest-Only Mortgages

Interest-only mortgages are relatively short-term loans, usually structured as ARMs for 5 to 10 years. During the loan, borrowers pay interest on the loan without repaying the principal. Since you’re not paying back any borrowed money, you’re not building equity in the home. Your equity in the house remains the value of the down payment and any appreciation in the home’s market value.

At the end of the loan term, your loan amount remains the same unless you’ve made separate payments to offset the principal. Once the initial term lapses, you can pay off the loan, switch to making amortized payments, refinance, or sign up for another interest-only term.

Interest-Only Mortgage Loan Requirements

An interest-only loan requires a good credit score, 700 or higher, a large deposit, and a low debt ratio. There are no standard requirements, so they vary widely between mortgage lenders. But you’ll need to demonstrate an ability to pay and own ample assets to qualify.

Pros

- Low initial monthly payment

- Low initial mortgage rates

- Variable loan terms

Cons

- You don’t build equity

- Your equity declines if property value drops

Best for: People with high disposable income, large cash reserves, rising incomes, or borrowers who receive large annual bonuses.

Best Mortgage Lenders FAQs

Which lenders have the best mortgage rates?

Mortgage rates can vary significantly from lender to lender, and can also fluctuate over time. It’s difficult to say which lender has the “best” mortgage rates at any given time. It can depend on a variety of factors, such as your credit score, the type of loan you’re looking for, and the location of the property you’re buying.

That being said, some lenders may offer more competitive rates than others. One way to find the best mortgage rates is to shop around and compare offers from different lenders. You can do this by visiting the websites of different banks and mortgage companies, or by working with a mortgage broker.

Another important factor to consider when shopping for a mortgage is the fees associated with the loan. Some lenders may have lower rates but charge higher fees, while others may have higher rates but charge lower fees. Make sure to compare the total cost of the loan, including the mortgage rate and fees, when shopping for a mortgage.

How do I get the best mortgage rate?

To get the best mortgage rate, you should:

- Have a good credit score. The higher your credit score, the more likely you are to qualify for a low mortgage rate.

- Shop around for rates from multiple lenders. Compare rates from banks, credit unions, and online lenders to find the best rate.

- Make a large down payment. Putting more money down on the home can lower your mortgage rate.

- Consider different loan types. Adjustable-rate mortgages and shorter-term mortgages typically have lower rates than fixed-rate mortgages.

- Consider paying “points” or additional fees to lower your rate.

- Get Pre-approved for a mortgage before you shop for a house.

- Be prepared to provide extensive documentation to the lender to show you can afford the loan and can make the payments.

It’s worth noting that interest rates are not the only thing to consider when shopping around for a mortgage. You should also compare other terms, fees, and loan programs that lenders offers. It’s always a good idea to consult a mortgage expert or a financial advisor for guidance on this matter.

How much house can I afford?

A widely accepted method for determining how much you can afford to spend on a home is the 28/36 rule. This rule states that you should not spend more than 28% of your gross, or pre-tax, monthly income on housing expenses.

Additionally, the rule states that you should not spend more than 36% of your income on all debt payments, including your mortgage, credit cards, and other loans, such as auto and student loans.

For example, if your gross monthly income is $5,000, you should not spend more than $1,400 (28% of $5,000) on housing expenses, including your mortgage payment, property taxes, and insurance. And you should not spend more than $1,800 (36% of $5,000) on all debt payments, including your mortgage, credit cards, and other loans, such as auto and student loans.

So, if you have $500 in existing debt payments, your monthly mortgage payment should not exceed $900.